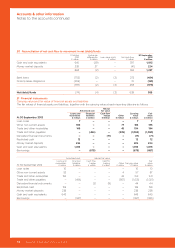

EasyJet 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com

$FFRXQWVRWKHULQIRUPDWLRQ

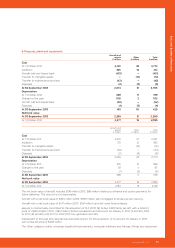

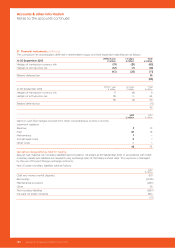

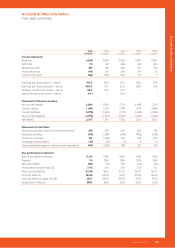

Amounts recorded in the income statement in respect of revaluation of monetary assets and liabilities and the gains

and losses on derivatives designated as held for trading are as follows:

PLOOLRQ

2012

£ million

Unrealised revaluation (losses)/gains on non-derivative financial instruments 8

Realised foreign exchange (losses)/gains on non-derivative financial instruments 10

Unrealised revaluation gains on other monetary assets and liabilities 7

Unrealised gains/(losses) on derivative financial instruments (16)

Realised losses on derivative financial instruments (8)

Net (losses)/gains (note 2) 1

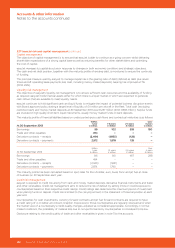

)LQDQFLDOULVNDQGFDSLWDOPDQDJHPHQW

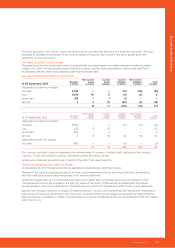

easyJet is exposed to financial risks including fluctuations in exchange rates, jet fuel prices and interest rates. Financial risk

management aims to limit these market risks with selected derivative hedging instruments being used for this purpose.

easyJet policy is not to trade in derivatives but to use the instruments to hedge anticipated exposure. As such, easyJet is

not exposed to market risk by using derivatives as any gains and losses arising are offset by the outcome of the underlying

exposure being hedged. In addition to market risks, easyJet is exposed to credit and liquidity risk.

The Board is responsible for setting financial risk and capital management policies and objectives which are implemented

by the treasury function on a day to day basis. The policy outlines the approach to risk management and also states

the instruments and time periods which the treasury function is authorised to use in managing financial risks. The policy

is regularly reviewed to ensure best practice, however there have been no significant changes during the current year.

"@OHS@KDLOKNXDC

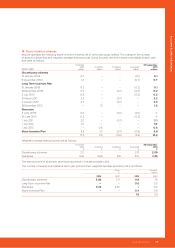

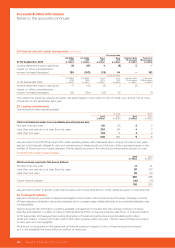

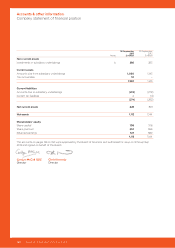

Capital employed comprises shareholders’ equity, borrowings, cash and money market deposits (excluding restricted

cash) and an adjustment for the capital implicit in aircraft operating lease arrangements. The adjustment is calculated

by multiplying the annual charge for aircraft dry leasing by a factor of seven, in line with accepted practice for the

airline industry.

Normalised operating profit is adjusted for the implied interest incorporated in the charge for aircraft dry leasing.

Consequently, the capital employed at the end of the current and prior year and the return earned during those years

were as follows:

PLOOLRQ

2012

£ million

Shareholders’ equity 1,794

Borrowings 957

Cash and money market deposits (excluding restricted cash) (883)

Reported capital employed 1,868

Operating leases adjustment 665

Capital employed including operating leases adjustment 2,533

Operating profit – reported 331

Implied interest in operating lease costs 32

Operating profit – adjusted 363

Operating profit after tax – adjusted 276

Return on capital employed 11.3%

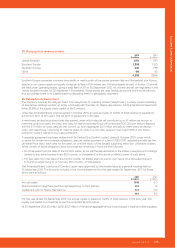

The percentage of operating leased aircrafts at 30 September 2013 was 33% (2012: 26%). Board policy is to hold around

30% of the fleet under operating lease arrangements to provide an appropriate degree of flexibility in fleet size.

121

www.easyJet.com

Accounts & other information