EasyJet 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

www.easyJet.com

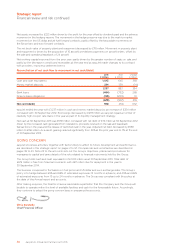

Strategic report

FINANCIAL PERFORMANCE

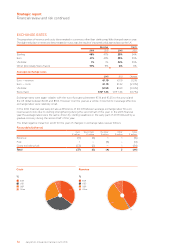

Revenue

2013 2012

£ million £ per seat

Pence per

ASK £ million £ per seat

Pence per

ASK

Seat revenue 4,194 61.64 5.65 3,794 57.61 5.26

Non-seat revenue 64 0.94 0.09 60 0.90 0.08

Total revenue 4,258 62.58 5.74 3,854 58.51 5.34

Revenue per seat improved by 7.0% to £62.58 in comparison to the prior year, with seat revenue

contributing to almost all of this increase. The primary driver for revenue per seat increase was the

improved yield, as easyJet took advantage of competitor capacity reduction on its routes and made

changes to its network, including the closure of the Madrid base, in order to drive capacity to markets

which deliver the highest returns. Load factor increased by 0.6 percentage points to 89.3%.

Revenue initiatives further drove the increase in revenue per seat, in particular the introduction of allocated

seating in November 2012 contributed £0.51 of this increase.

Non-seat revenue per seat performance stabilised after falling last year. Commissions earned from travel

insurance continued to decline however this was offset by improved in-flight sales.

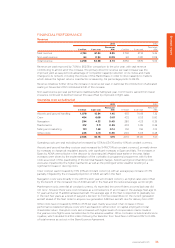

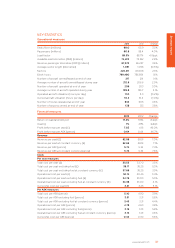

Operating costs excluding fuel

2013 2012

£ million £ per seat

Pence per

ASK £ million £ per seat

Pence per

ASK

Airports and ground handling 1,078 15.84 1.45 955 14.49 1.32

Crew 454 6.68 0.61 432 6.55 0.60

Navigation 294 4.33 0.40 280 4.25 0.39

Maintenance 212 3.11 0.29 203 3.08 0.28

Selling and marketing 101 1.49 0.14 104 1.58 0.14

Other costs 226 3.31 0.30 200 3.05 0.28

2,365 34.76 3.19 2,174 33.00 3.01

Operating costs per seat excluding fuel increased by 5.3% to £34.76 and by 4.1% at constant currency.

Airports and ground handling cost per seat increased by 9.4% (7.9% at constant currency), primarily driven

by increases in charges at regulated airports, with significant increases in Spain and Italy. The increases in

Spain by AENA were a factor in the decision to close easyJet’s Madrid base earlier in the year. Italian

increases were driven by the implementation of the ‘contratto di programma’ programme, with further

costs as a result of the quadrupling of the terminal Navaid charges. Airports and ground handling costs

were also impacted by the higher load factor as well as the prolonged winter weather resulting in a

significant increase in de-icing costs.

Crew cost per seat increased by 1.9% (1.1% at constant currency), with an average pay increase of 1.7%

partially mitigated by the increased proportion of A320 aircraft in the fleet.

Navigation costs were broadly in line with the prior year at constant currency, as higher rates were offset

by the benefit of the increased mix of A320 aircraft in the fleet and the reduced average sector length.

Maintenance costs were flat at constant currency. As expected, the one-off items incurred last year did

not recur, however there were cost increases as a consequence of an increase in the average fleet age to

5.1 years and a net 17 additional leased aircraft. The average age of the fleet is expected to gradually rise

in the next few years as a result of easyJet’s decision to minimise expenditure on the current generation

aircraft ahead of the fleet order to acquire new generation A320neo aircraft, due for delivery from 2017.

Other costs have increased by 8.5% to £3.31 per seat, mainly as a result of an increase in those

performance-related employee costs which are based on either return on capital employed or total

shareholder return. Disruption costs also increased with higher levels of compensation claims made in

the year as more flights were cancelled due to the adverse weather. Other costs also include brand licence

royalties, which doubled to £10.6 million following the transition from fixed fees in 2011 and 2012 to 0.25%

of total revenue as set out in the Brand Licence Agreement.