EasyJet 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

www.easyJet.com

$FFRXQWVRWKHULQIRUPDWLRQ

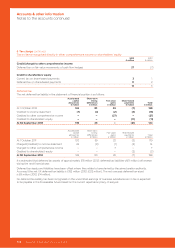

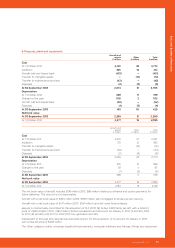

7D[FKDUJH

Tax on profit on ordinary activities

PLOOLRQ

2012

£ million

&XUUHQWWD[

United Kingdom corporation tax 37

Foreign tax 11

Prior year adjustments –

Total current tax charge 48

'HIHUUHGWD[

Temporary differences relating to property, plant and equipment 42

Other temporary differences (8)

Prior year adjustments (2)

Change in tax rate (18)

Total deferred tax (credit)/charge 14

62

Effective tax rate 20%

As a consequence of legislation being enacted in the year reducing the UK corporation tax rate to 20% from 1 April 2015,

deferred tax in the year has been provided at 20% (2012: 23%). The consequent reduction in deferred tax liabilities of

£28 million (2012: £18 million) is a credit to the income statement tax charge and so lowering the overall effective tax

rate to 17% (2012: 20%).

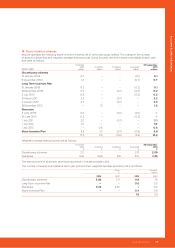

1DBNMBHKH@SHNMNESGDSNS@KS@WBG@QFD

The tax for the year is lower than the standard rate of corporation tax in the UK as set out below:

PLOOLRQ

2012

£ million

Profit on ordinary activities before tax 317

Tax charge at 23.5% (2012: 25%) 79

Income not chargeable for tax purposes –

Expenses not deductible for tax purposes 7

Share-based payments 1

Adjustments in respect of prior years – current tax –

Adjustments in respect of prior years – deferred tax (2)

Utilisation of previously unrecognised losses ± (5)

Change in tax rate (18)

62

Current tax liabilities at 30 September 2013 amounted to £58 million (2012: £29 million). £50 million of this relates to tax

payable in the UK, the remaining amount of £8 million is in respect of tax due in other European countries.

During the year ended 30 September 2013, net cash tax paid amounted to £65 million (2012: £28 million).

107

www.easyJet.com

Accounts & other information