EasyJet 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

www.easyJet.com

Strategic report

CAPITAL DISCIPLINE

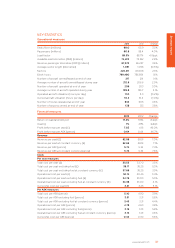

Risk description and potential impact Current mitigation

Asset allocation

easyJet has a leading presence on the top 100 routes in

Europe and positions at primary airports that are attractive to

time sensitive consumers. easyJet manages the performance

of its network by careful allocation of aircraft to routes and

optimisation of its flying schedule.

If easyJet fails to continue to optimise its network and fleet

plan, this will have a major impact on easyJet’s ability to grow

and gain the required yield. In addition, poor planning of the

correct number of aircraft to fly the schedule would have a

critical impact on easyJet’s costs and reputation.

A network portfolio management strategy is in place which

looks to take a balanced approach to the route portfolio that

easyJet flies, to ensure that it optimises each aircraft to get the

best return for each time of day and each day of the week.

Route performance is monitored on a regular basis and

operating decisions are made to improve performance

where required.

The fleet framework arrangements in place, together with our

leasing policy, provide easyJet with significant flexibility in

respect of scaling the fleet according to business requirements.

Exposure to fuel price fluctuations and other

macroeconomic shifts

Sudden and significant increases in jet fuel price and

movements in foreign exchange rates would significantly

impact fuel and other costs. Increases in fuel costs would have

an adverse effect on the financial performance of easyJet if

not protected against.

easyJet’s business can also be affected by macroeconomic

issues outside of its control such as weakening consumer

confidence, inflationary pressure or instability of the euro. This

could give rise to adverse pressure on revenue, load factors

and residual values of aircraft.

A Board approved hedging policy (fuel and currency) is in

place that is consistently applied. The policy is to hedge within

a percentage band for a rolling 24 month period.

To provide protection, easyJet uses a limited range of hedging

instruments traded in the over-the-counter (OTC) markets.

These are principally forward purchases with a number of

approved counterparties.

A strong balance sheet supports the business through

fluctuations in the economic conditions for the sector.

Regular monitoring of markets and route performance is

undertaken by easyJet’s network and fleet management teams.

Financing and interest rate risk

All of easyJet’s debt is asset-related, reflecting the capital

intensive nature of the airline industry.

Market conditions could change the cost of finance which may

have an adverse effect on easyJet’s financial performance.

easyJet presently finances its fleet through a mix of sale and

leaseback transactions, internal resources, cash flow and bank

borrowing. In the future easyJet may use forms of debt, sale

and leaseback transactions or other financing structures, which

may include the sale or securitisation of aircraft or public debt

offers where the Board considers these sources of financing

more favourable.

easyJet’s interest rate management policy is based on a

natural hedge with cash deposits mirroring floating debt.

None of the agreements contain financial covenants.

A portion of US dollar mortgage debt is matched with

US dollar money market deposits.

Operating lease rentals are a mix of fixed and floating rates.

Liquidity risk

easyJet continues to hold significant cash or liquid funds as

a form of insurance.

A misjudgement in the level of liquidity required could result in

business disruption and have an adverse effect on easyJet’s

financial performance.

Board policy is to maintain target liquidity at £4 million per

aircraft. This allows the business to better manage the impact

of downturns in business or temporary curtailment of activities

(e.g. fleet grounding, security incident, extended industrial

dispute at key supplier).

Counterparty risk

Surplus funds are invested in high quality short-term liquid

instruments, usually money market funds or bank deposits.

There is a possibility of loss arising in the event of non-

performance of counterparties.

Cash is placed on deposit with institutions based upon their

credit rating with a maximum exposure of £200 million for any

individual AAA counterparty money market fund.