EasyJet 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

www.easyJet.com

Strategic report

Disciplined use of capital

easyJet allocates its aircraft and capacity to

optimise the returns across its network. easyJet

discontinued 41 routes during the financial year

including Liverpool to Brussels, Amsterdam to

Barcelona and Brest to Paris Charles de Gaulle. The

Madrid base closure was implemented efficiently

and the withdrawn capacity was allocated to routes

which have the potential to drive higher returns.

easyJet maintains a strong balance sheet and

low gearing and derives a competitive advantage

through access to funding at a lower cost. Over

the cycle, easyJet is committed to earning returns

in excess of its cost of capital, and intends to fund

both aircraft purchases and dividends from the

cash generated from the business.

easyJet has the following targets to ensure its

capital structure remains both robust and efficient:

• a maximum gearing of 50%, giving investors and

finance providers assurance that easyJet will not

over-leverage;

• a limit of £10 million net debt per aircraft; and

• a target of £4 million liquidity per aircraft.

These measures allow easyJet to withstand external

shocks such as an extended closure of airspace,

significant fuel price increases or a sustained period

of low yields whilst being in a position to drive

growth and returns for shareholders.

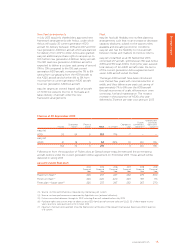

As at 30 September 2013, easyJet had cash

and money market deposits of £1,237 million, an

increase of £354 million on 30 September 2012

and net cash of £558 million against net debt of

£74 million at the same period last year. Adjusted

net debt, including leases at seven times at

30 September 2013 was £156 million against

£739 million at 30 September 2012.

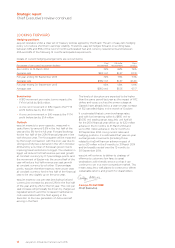

easyJet is focused on driving returns for shareholders

and, consistent with this focus, the Board considers

returns in addition to its ordinary dividend based

on three times cover to reduce excess capital.

easyJet finished the year with a strong balance

sheet and a low level of gearing and therefore the

Board is recommending a return to shareholders

of £308 million or 77.6 pence per share which will

be in the form of a special dividend of £175 million

or 44.1 pence per share and the regular ordinary

dividend paid at three times cover of £133 million

or 33.5 pence per share. The ordinary and special

dividend are subject to shareholder approval at the

Company’s AGM on 13 February 2014. The ordinary

and special dividends will be paid on 21 March 2014

to shareholders on the register at close of business

on 28 February 2014.

£308m

proposed dividends

(2012: £85m)

(8) Source: customer satisfaction from Millward Brown and GfK.

(9) Source: google analytics.

(10) Source: internal easyJet definition based on booking algorithm.

(11) Source: Business travel market share from PhoCusWright report.