EasyJet 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 easyJet plc Annual report and accounts 2013

Strategic report

Financial review and risk continued

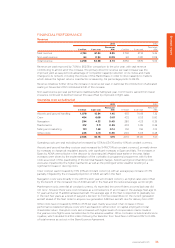

Fuel

2013 2012

£ million £ per seat

Pence per

ASK £ million £ per seat

Pence per

ASK

Fuel 1,182 17.38 1.59 1,149 17.45 1.59

The market price for jet fuel traded between $900 and $1,100 per tonne during the year, and easyJet’s

average market price paid was $992. After taking account of hedging, easyJet’s average effective fuel price

was $980, in line with last year. This, together with the increased proportion of A320 aircraft in the fleet

and a small reduction in average sector length, resulted in a small decline in fuel cost per seat.

For much of the year future fuel prices were below spot price and we have purchased forward 1.4 million

tonnes of fuel for 2014 and 2015 at an average price of $948 per tonne. As a result the hedged

percentages are 72% for 2014 at $982 per tonne and 56% for 2015 at $950 per tonne.

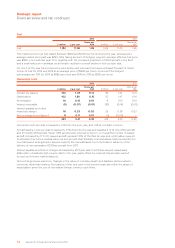

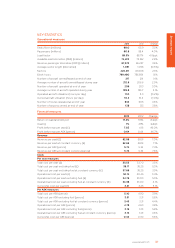

Ownership costs

2013 2012

£ million £ per seat

Pence per

ASK £ million £ per seat

Pence per

ASK

Aircraft dry leasing 102 1.49 0.14 95 1.44 0.13

Depreciation 102 1.50 0.15 97 1.47 0.14

Amortisation 10 0.15 0.01 8 0.12 0.01

Interest receivable (5) (0.07) (0.01) (10) (0.14) (0.01)

Interest payable and other

financing charges 16 0.23 0.02 25 0.38 0.03

Net exchange losses/(gains) 8 0.11 0.01 (1) (0.02) –

233 3.41 0.32 214 3.25 0.30

Ownership costs per seat increased by 5.1% from the prior year, and 1.4% at constant currency.

Aircraft leasing costs per seat increased by 3.7% driven by the sale and leaseback of 12 new A320 aircraft

and 12 mid-life A319 aircraft. Seven A319 aircraft were returned to lessors, so overall the number of leased

aircraft increased by 17 to 72. Leased aircraft represent 33% of the fleet at year end, which allows easyJet

to eliminate their future residual value risk and provide fleet flexibility over and above that provided by the

new framework arrangements. easyJet expects the owned/leased mix to fluctuate in advance of the

delivery of new generation A320neo aircraft from 2017.

Interest payable and finance charges decreased by £0.15 per seat to £0.23 as easyJet repaid early

£186 million of relatively high-coupon debt in the year, partly offset by reduced interest rates earned

on cash and money market deposits.

Net exchange losses arise from changes in the value of monetary assets and liabilities denominated in

currencies other than sterling. Fluctuations of the size seen in the last few years are within the range of

expectations given the size of the related foreign currency cash flows.