EasyJet 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 easyJet plc Annual report and accounts 2013

Strategic report

Chief Executive’s review continued

STRATEGIC PROGRESS

easyJet flies to airports people want to fly

to; its principal competitors at these primary

airports are the legacy carriers and charter

airlines. easyJet has a significant cost

advantage relative to these airlines allowing

it to offer customers more affordable fares.

This cost advantage is driven through a

combination of factors including aircraft

configuration with easyJet carrying a higher

number of seats per aircraft; easyJet’s

higher load factors and higher aircraft

utilisation driven by its point-to-point model;

its younger fleet and advantaged fleet deal

reducing ownership and maintenance costs

and easyJet’s leaner overhead costs.

easyJet is confident that its strategy of building

on its competitive advantages of a strong network

and market positions, efficient low-cost model,

pan-European brand and strong balance sheet

will position it to deliver sustainable returns and

growth for shareholders.

In order to deliver on its strategy, easyJet has four

key objectives:

For shareholders, this will deliver: sustainable and

flexible growth; industry leading returns and tangible

and regular cash returns via ordinary dividends paid

out at a third of post-tax profit; and, in addition, a

policy of distributing excess cash to shareholders.

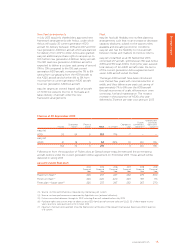

easyJet undertook a highly competitive, rigorous

and thorough process to secure the necessary

fleet arrangements to deliver this sustainable and

flexible growth. In July 2013, following an 18 month

process, easyJet’s shareholders approved new fleet

arrangements with Airbus which provide the platform

to deliver this growth until 2022. easyJet secured

the delivery of 35 current generation A320 aircraft

and 100 new generation A320neo aircraft between

2015 and 2022 with purchase rights over a further

100 A320neo family aircraft. Of the 135 aircraft

to be delivered, 85 aircraft will be for the planned

replacement of the existing fleet as it ages. easyJet

negotiated a significant amount of flexibility in the

fleet order to provide protection in the event of

negative changes in the external environment with

the ability to reduce the fleet size to 171 by 2022

compared to the current fleet size of 217. There is

also flexibility to increase the fleet size to 298 by

2022. Importantly, the new fleet arrangements are

expected to be funded through a combination of

easyJet’s internal resources, cashflow, sale and

leaseback transactions and debt and easyJet expects

the ability to deliver cash returns to shareholders to

be enhanced.

Build strong number

1 and 2 network positions

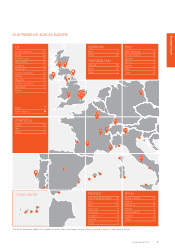

easyJet has developed the leading pan-European

network by building up a valuable portfolio of slots,

held at slot constrained, primary airports over several

years. easyJet connects more of the top European

city-to-city market pairs than any other airline and its

network is a clear competitive advantage. easyJet

has number 1 or 2 market positions at slot

constrained airports including London Gatwick,

Geneva, Paris Orly and Milan Malpensa.

easyJet regularly reviews its route portfolio and

re-orientates its network to optimise returns.

Significant changes to the network this year

include the closure of the Madrid base.

easyJet has a market share of around 8%(2) in the

total intra-European market and around 31% share

in easyJet’s key markets.(2) An overview of the

developments in each of easyJet’s key markets

is shown below.

Country review

UK

easyJet is the largest short-haul carrier in the UK

with a market share of around 20%.(2) easyJet saw

growth at Gatwick, Manchester and Edinburgh.

In March, easyJet introduced flights to Moscow

from Gatwick, having won the right to fly from

London as part of a bilateral agreement with Russia.

easyJet has also launched flights from Manchester

to Moscow. Other significant new routes from the

UK include Luxembourg from Gatwick and Tel Aviv

from Manchester. In addition during the year

capacity was increased on business routes such as

Copenhagen from Gatwick.

In May, easyJet announced the purchase of 25 slot

pairs at Gatwick from Flybe for a total consideration

of £20 million. These slots will transfer at the start

of the summer 2014 season and be used to further

build the route portfolio at Gatwick and depth on

Build strong

number 1 and

2 network

positions

Drive demand,

conversion and

yields across

Europe

Maintain cost

advantage

Disciplined use

of capital

(2) Source: Market share figures from OAG. Size of European market based on internal easyJet definition. Historical data based

on 12 month period from October 2012 to September 2013.