EasyJet 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.easyJet plc Annual report and accounts 2013

78

How did we choose performance metrics and

how do we set performance targets?

The performance metrics that are used for our

annual bonus and LTIP have been selected to reflect

the Group’s key performance indicators.

Profit before tax is used to assess annual

performance as this reflects how successful we have

been in managing our operations effectively (e.g. in

maximising profit per seat whilst maintaining a high

load factor). The balance is determined based on

how well we perform against other specific key

performance indicators set annually (e.g. on-time

performance and customer satisfaction) to ensure

that Executive Directors are motivated to deliver

across a scorecard of objectives.

Since safety is of central importance to the

business, the award of any bonus is subject to an

underpin that enables the Remuneration Committee

to reduce the bonus earned in the event that there

is a safety event that occurs that it considers

warrants the use of such discretion.

LTIP awards are earned for delivering performance

against ROCE (which, since December 2012 has

included operating lease adjustments) and relative

TSR targets. These seek to assess the underlying

financial performance of the business while

maintaining clear alignment between shareholders

and Executive Directors.

Targets are set based on a sliding scale that takes

account of relevant commercial factors. Only

modest rewards are available for delivering

threshold performance levels with maximum

rewards requiring substantial out-performance

of our challenging plans.

No performance targets are set for Sharesave and

Share Incentive Plan awards since these form part

of all-employee arrangements that are purposefully

designed to encourage employees across the

Group to purchase shares in the Company.

Have LTIP Awards always been granted subject

to the same performance targets?

The LTIP, under which the Performance and

Matching Share Awards are granted, was approved

by shareholders in 2008. Further details on how the

awards are structured and operated are set out in

the plan rules which are available on request from

the Company.

The policy set out above applies to awards granted

from the 2013 financial year onwards. Awards

granted under the previous policy, are subject to

different performance measures (typically ROE or

ROCE as the sole performance measure), have

different award levels and may be earned in line

with the terms of their grant in due course. Details

of all the outstanding share awards granted to

existing Executive Directors are set out in the

Annual Report on Remuneration.

How does the executive pay policy differ from

that for other easyJet employees?

The remuneration policy for the Executive Directors

is more heavily weighted towards variable pay than

for other employees to make a greater part of their

pay conditional on the successful delivery of

business strategy. This aims to create a clear link

between the value created for shareholders and the

remuneration received by the Executive Directors.

However, in line with the Company’s strategy to

keep remuneration simple and consistent, the

benefit and pension arrangements for the current

Executive Directors are on the same terms as those

offered to eligible employees below the Board.

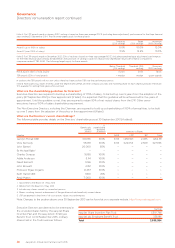

How much could the Executive Directors earn

under the remuneration policy?

A significant proportion of remuneration is linked to

performance, particularly at maximum performance

levels. The charts on page 79 show how much the

CEO and CFO could earn under easyJet’s

remuneration policy (as detailed above) under

different performance scenarios (based on their

salaries as at 1 October 2013). The following

assumptions have been made:

• Minimum (performance below threshold) – Fixed

pay only with no vesting under any of easyJet’s

incentive plans.

• In line with expectations – Fixed pay plus a

bonus at the mid-point of the range (giving 50%

of the maximum opportunity and assuming half of

the maximum voluntary deferral) and vesting of

one third of the maximum under the Performance

and Matching Share elements of the LTIP.

• Maximum (performance meets or exceeds

maximum) – Fixed pay plus maximum bonus

(with maximum voluntary deferral) and maximum

vesting under the Performance and Matching

Shares elements of the LTIP.

Fixed pay comprises:

• salaries – salary effective as at 1 October 2013;

• benefits – amount received by each

Executive Director in the 2013 financial year;

• pension – amount received by each

Executive Director in the 2013 financial year; and

• Free and Matching Shares under the all

employee share incentive plan.

The scenarios do not include any share price

growth or dividend assumptions.

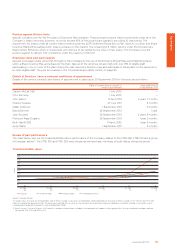

It should be noted that since the analysis above shows

what could be earned by the Executive Directors

based on the 2014 financial year remuneration policy

described above (ignoring the potential impact of

share price growth), the numbers will be different to

the values included in the table on page 83 detailing

what was actually earned by the Executive Directors

in relation to the financial year ended 30 September

2013, since these values are based on the actual levels

of performance achieved to 30 September 2013 and

include the impact of share price growth in relation to

share awards.

Governance

Directors’ remuneration report continued