Cisco 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

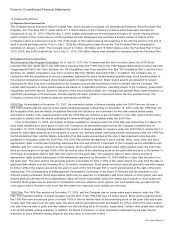

because the Company used unobservable inputs to value them, reflecting the Company’s assessment of the assumptions market

participants would use in pricing these investments due to the absence of quoted market prices and inherent lack of liquidity. The

losses for the investments in privately held companies were recorded to other income (loss), net.

The fair values for purchased intangible assets and property held for sale were measured using discounted cash flow

techniques. These assets were classified as Level 3 assets because the Company used unobservable inputs to value them,

reflecting the Company’s assessment of the assumptions market participants would use in valuing these assets. The losses for

purchased intangible assets were included in amortization of purchased intangible assets, and the net losses for property held for

sale were included in G&A expenses.

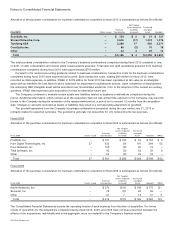

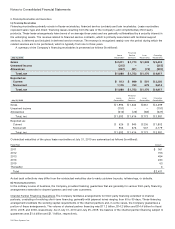

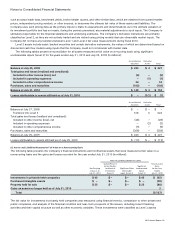

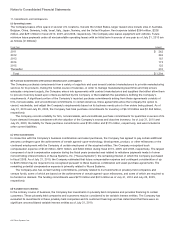

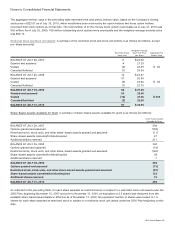

The following table presents the Company’s financial instruments that were measured at fair value on a nonrecurring basis and

the losses recorded for the year ended July 25, 2009 (in millions):

FAIR VALUE MEASUREMENTS USING

Net Carrying

Value as of

July 25, 2009

Quoted Prices in

Active Markets

for Identical

Instruments

(Level 1)

Significant Other

Observable

Inputs (Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total Losses

for the Year

Ended

July 25, 2009

Investments in privately held companies $ 69 $ — $ — $ 69 $ (78)

Losses on assets no longer held as of July 25, 2009 (9)

Total $ (87)

(d) Other

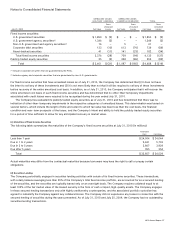

The fair value of certain of the Company’s financial instruments that are not measured at fair value, including accounts receivable,

accounts payable, accrued compensation, and other current liabilities, approximates the carrying amount because of their short

maturities. In addition, the fair value of the Company’s loan receivables and financed service contracts also approximates the

carrying amount. The fair value of the Company’s debt is disclosed in Note 9 and was determined using quoted market prices for

those securities.

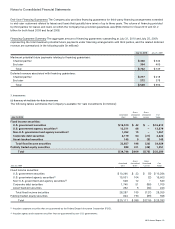

9. Borrowings

(a) Debt

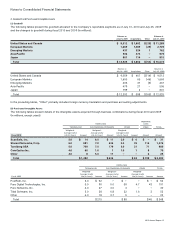

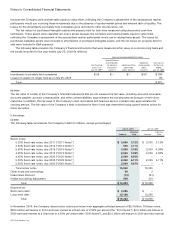

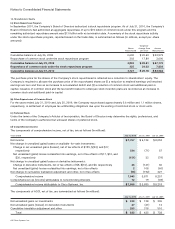

The following table summarizes the Company’s debt (in millions, except percentages):

July 31, 2010 July 25, 2009

Amount

Effective

Rate Amount

Effective

Rate

Senior notes:

5.25% fixed-rate notes, due 2011 (“2011 Notes”) $ 3,000 3.12% $ 3,000 3.12%

2.90% fixed-rate notes, due 2014 (“2014 Notes”) 500 3.11% ——

5.50% fixed-rate notes, due 2016 (“2016 Notes”) 3,000 3.18% 3,000 4.34%

4.95% fixed-rate notes, due 2019 (“2019 Notes”) 2,000 5.08% 2,000 5.08%

4.45% fixed-rate notes, due 2020 (“2020 Notes”) 2,500 4.50% ——

5.90% fixed-rate notes, due 2039 (“2039 Notes”) 2,000 6.11% 2,000 6.11%

5.50% fixed-rate notes, due 2040 (“2040 Notes”) 2,000 5.67% ——

Total senior notes 15,000 10,000

Other notes and borrowings 59 2

Unaccreted discount (73) (21)

Hedge accounting adjustment 298 314

Total $ 15,284 $ 10,295

Reported as:

Short-term debt $ 3,096 $—

Long-term debt 12,188 10,295

Total $ 15,284 $ 10,295

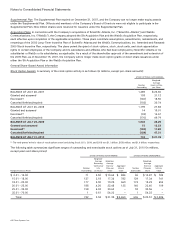

In November 2009, the Company issued senior unsecured notes in an aggregate principal amount of $5.0 billion. Of these notes,

$500 million will mature in 2014 and bear interest at a fixed rate of 2.90% per annum (the “2014 Notes”), $2.5 billion will mature in

2020 and bear interest at a fixed rate of 4.45% per annum (the “2020 Notes”), and $2.0 billion will mature in 2040 and bear interest

60 Cisco Systems, Inc.