Cisco 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

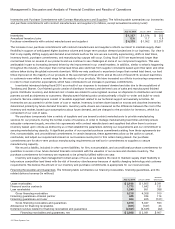

Amortization of Purchased Intangible Assets

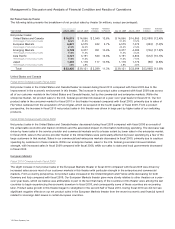

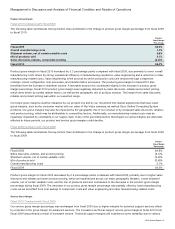

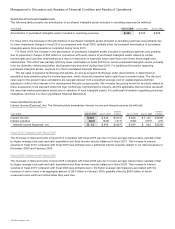

The following table presents the amortization of purchased intangible assets included in operating expenses (in millions):

Years Ended July 31, 2010 July 25, 2009 July 26, 2008

Amortization of purchased intangible assets included in operating expenses $ 491 $ 533 $ 499

For fiscal 2010, the decrease in the amortization of purchased intangible assets included in operating expenses was primarily due

to lower impairment charges in fiscal 2010 as compared with fiscal 2009, partially offset by increased amortization of purchased

intangible assets from acquisitions completed during fiscal 2010.

For fiscal 2009, the increase in the amortization of purchased intangible assets included in operating expenses was primarily

due to impairment charges of $95 million in connection with write-downs of purchased intangible assets related to certain

technologies and customer relationships as a result of reductions in expected future cash flows from those technologies and

relationships. This effect was partially offset by lower amortization in fiscal 2009 from certain purchased intangible assets, primarily

from the Scientific-Atlanta acquisition, that became fully amortized during fiscal 2009. For additional information regarding

purchased intangible assets, see Note 4 to the Consolidated Financial Statements.

The fair value of acquired technology and patents, as well as acquired technology under development, is determined at

acquisition date primarily using the income approach, which discounts expected future cash flows to present value. The discount

rates used in the present value calculations are typically derived from a weighted-average cost of capital analysis and then

adjusted to reflect risks inherent in the development lifecycle as appropriate. We consider the pricing model for products related to

these acquisitions to be standard within the high-technology communications industry, and the applicable discount rates represent

the rates that market participants would use for valuation of such intangible assets. For additional information regarding purchased

intangibles, see Note 4 to the Consolidated Financial Statements.

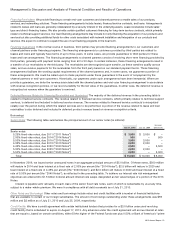

Interest and Other Income, Net

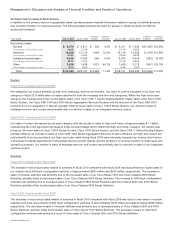

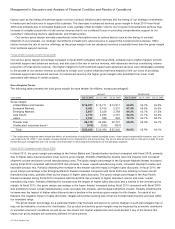

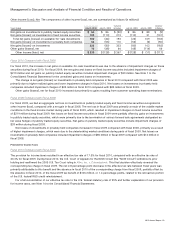

Interest Income (Expense), Net The following table summarizes interest income and interest expense (in millions):

Years Ended July 31, 2010 July 25, 2009

Variance

in Dollars July 25, 2009 July 26, 2008

Variance

in Dollars

Interest income $ 635 $ 845 $ (210) $ 845 $ 1,143 $ (298)

Interest expense (623) (346) (277) (346) (319) (27)

Interest income (expense), net $12 $ 499 $ (487) $ 499 $ 824 $ (325)

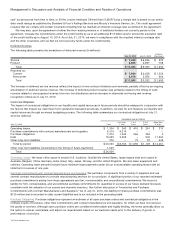

Fiscal 2010 Compared with Fiscal 2009

The decrease in interest income in fiscal 2010 compared with fiscal 2009 was due to lower average interest rates, partially offset

by higher average total cash and cash equivalents and fixed income security balances in fiscal 2010. The increase in interest

expense in fiscal 2010 compared with fiscal 2009 was primarily due to additional interest expense related to our debt issuances in

November 2009 and February 2009.

Fiscal 2009 Compared with Fiscal 2008

The decrease in interest income in fiscal 2009 compared with fiscal 2008 was due to lower average interest rates, partially offset

by higher average total cash and cash equivalents and fixed income security balances in fiscal 2009. The increase in interest

expense in fiscal 2009 compared with fiscal 2008 was primarily due to the higher average debt balances associated with the

issuance of senior notes in an aggregate amount of $4.0 billion in February 2009, partially offset by $500 million of senior

unsecured notes which we retired when they were due.

28 Cisco Systems, Inc.