Cisco 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

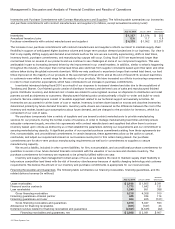

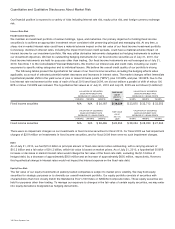

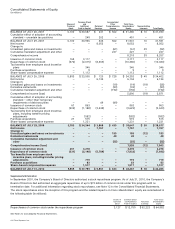

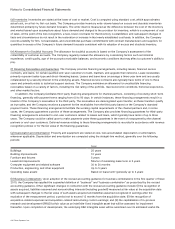

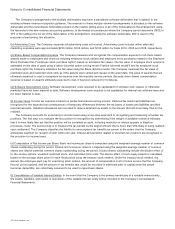

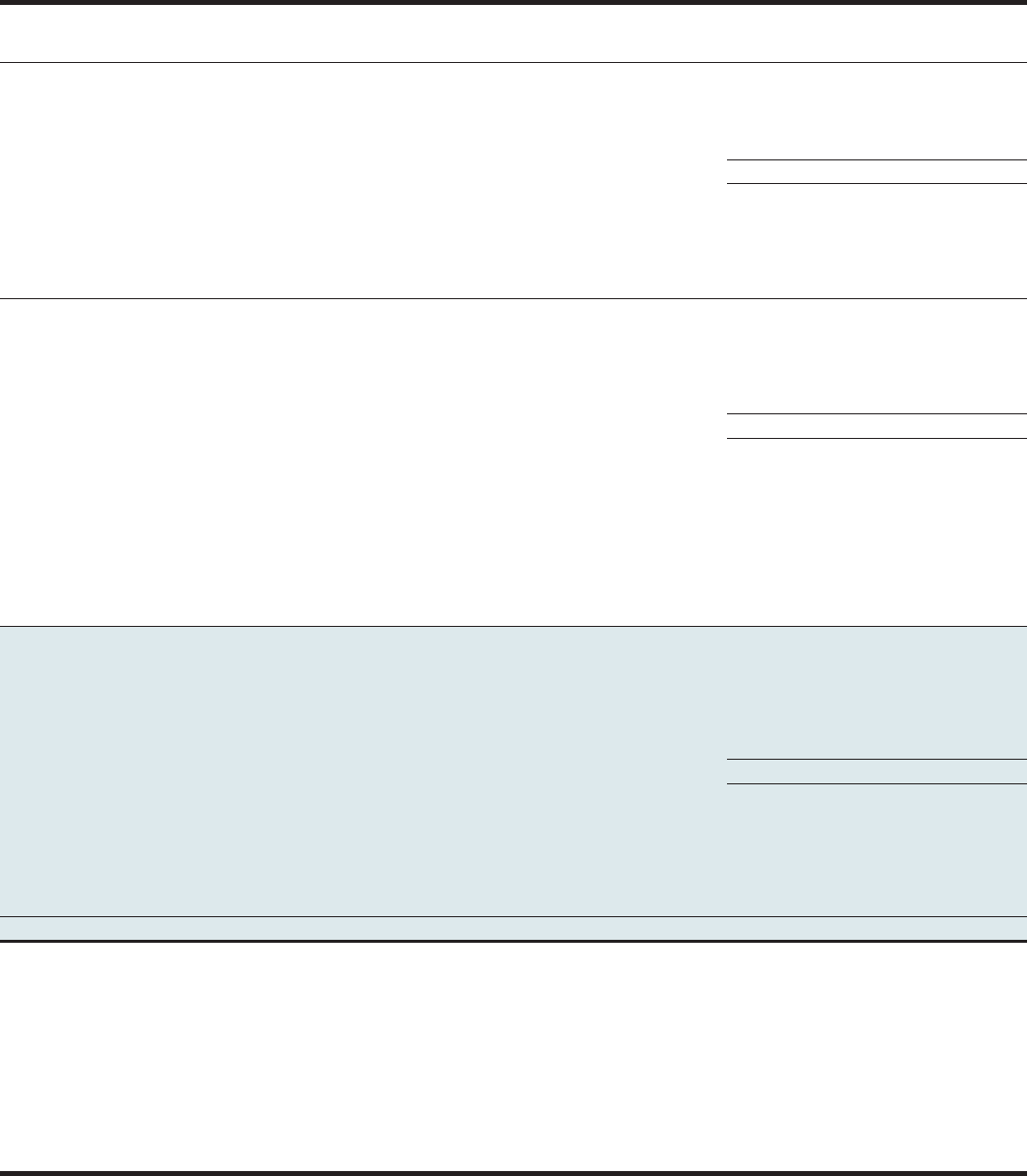

Consolidated Statements of Equity

(in millions)

Shares of

Common

Stock

Common Stock

and

Additional

Paid-In Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Total Cisco

Shareholders’

Equity

Noncontrolling

Interests Total Equity

BALANCE AT JULY 28, 2007 6,100 $ 30,687 $ 231 $ 562 $ 31,480 $ 10 $ 31,490

Cumulative effect of adoption of accounting

standard — uncertain tax positions — 249 202 — 451 — 451

BALANCE AT JULY 29, 2007 6,100 30,936 433 562 31,931 10 31,941

Net income — — 8,052 — 8,052 — 8,052

Change in:

Unrealized gains and losses on investments — — — (61) (61) 39 (22)

Cumulative translation adjustment and other — — — 227 227 — 227

Comprehensive income 8,218 39 8,257

Issuance of common stock 165 3,117 — — 3,117 — 3,117

Repurchase of common stock (372) (2,015) (8,365) — (10,380) — (10,380)

Tax benefits from employee stock incentive

plans — 346 — — 346 — 346

Purchase acquisitions — 9 — — 9 — 9

Share-based compensation expense — 1,112 — — 1,112 — 1,112

BALANCE AT JULY 26, 2008 5,893 $ 33,505 $ 120 $ 728 $ 34,353 $ 49 $ 34,402

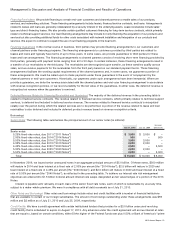

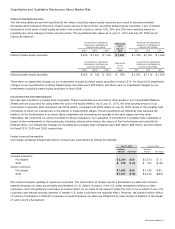

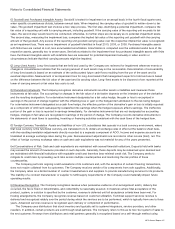

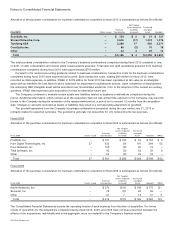

Net income — — 6,134 — 6,134 — 6,134

Change in:

Unrealized gains and losses on investments — — — (19) (19) (19) (38)

Derivative instruments — — — (33) (33) — (33)

Cumulative translation adjustment and other — — — (192) (192) — (192)

Comprehensive income (loss) 5,890 (19) 5,871

Cumulative effect of adoption of accounting

standard — other-than-temporary

impairments of debt securities — — 49 (49) — — —

Issuance of common stock 67 863 — — 863 — 863

Repurchase of common stock (202) (1,188) (2,435) — (3,623) — (3,623)

Tax benefits from employee stock incentive

plans,including transfer pricing

adjustments — (582) — — (582) — (582)

Purchase acquisitions 27 515 — — 515 — 515

Share-based compensation expense — 1,231 — — 1,231 — 1,231

BALANCE AT JULY 25, 2009 5,785 $ 34,344 $ 3,868 $ 435 $ 38,647 $ 30 $ 38,677

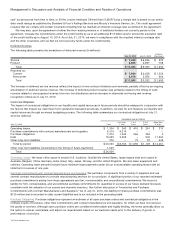

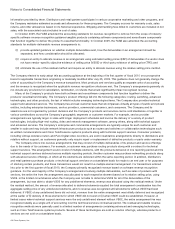

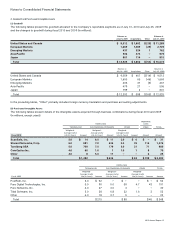

Net income — — 7,767 — 7,767 — 7,767

Change in:

Unrealized gains and losses on investments — — — 195 195 (12) 183

Derivative instruments — — — 48 48 — 48

Cumulative translation adjustment and

other — — — (55) (55) — (55)

Comprehensive income (loss) 7,955 (12) 7,943

Issuance of common stock 201 3,278 — — 3,278 — 3,278

Repurchase of common stock (331) (2,148) (5,784) — (7,932) — (7,932)

Tax benefits from employee stock

incentive plans, including transfer pricing

adjustments — 719 — — 719 — 719

Purchase acquisitions — 83 — — 83 — 83

Share-based compensation expense — 1,517 — — 1,517 — 1,517

BALANCE AT JULY 31, 2010 5,655 $ 37,793 $ 5,851 $ 623 $ 44,267 $ 18 $ 44,285

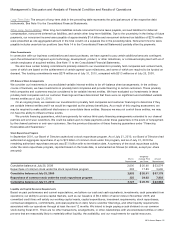

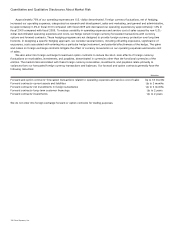

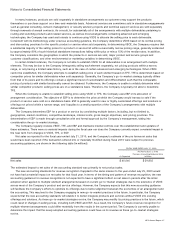

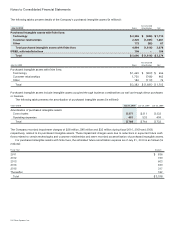

Supplemental Information

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 31, 2010, the Company’s

Board of Directors had authorized an aggregate repurchase of up to $72 billion of common stock under this program with no

termination date. For additional information regarding stock repurchases, see Note 12 to the Consolidated Financial Statements.

The stock repurchases since the inception of this program and the related impacts on Cisco shareholders’ equity are summarized in

the following table (in millions):

Shares of

Common

Stock

Common Stock

and Additional

Paid-In Capital

Retained

Earnings

Total Cisco

Shareholders’

Equity

Repurchases of common stock under the repurchase program 3,127 $ 12,759 $ 52,223 $ 64,982

See Notes to Consolidated Financial Statements.

42 Cisco Systems, Inc.