3M 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

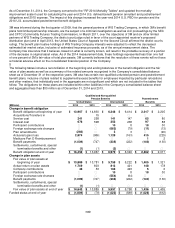

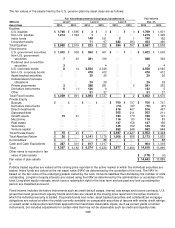

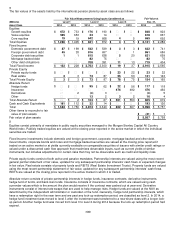

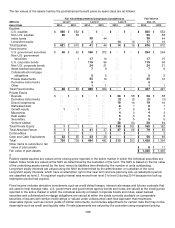

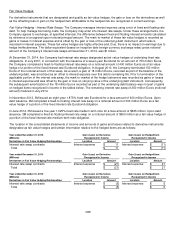

The fair values of the assets held by the international pension plans by asset class are as follows:

Fair Value Measurements Using Inputs Considered as

Fair Value at

(Millions)

Level 1

Level 2

Level 3

Dec. 31,

Asset Class

2014

2013

2014

2013

2014

2013

2014

2013

Equities

Growth equities

$

672

$ 733

$

176

$ 190

$

―

$ ―

$

848

$

923

Value equities

595

653

23

14

―

―

618

667

Core equities

19

19

642

668

4

5

665

692

Total Equities

$

1,286

$ 1,405

$

841

$ 872

$

4

$ 5

$

2,131

$

2,282

Fixed Income

Domestic government debt

$

87

$ 199

$

542

$ 539

$

3

$ 3

$

632

$

741

Foreign government debt

45

28

816

657

―

1

861

686

Corporate debt securities

1

1

615

638

5

20

621

659

Mortgage backed debt

―

―

82

75

―

―

82

75

Other debt obligations

―

―

708

391

11

13

719

404

Total Fixed Income

$

133

$ 228

$

2,763

$ 2,300

$

19

$ 37

$

2,915

$

2,565

Private Equity

Private equity funds

$

―

$ ―

$

―

$ ―

$

23

$ 22

$

23

$

22

Real estate

3

3

73

87

55

53

131

143

Total Private Equity

$

3

$ 3

$

73

$ 87

$

78

$ 75

$

154

$

165

Absolute Return

Hedge funds

$

―

$ ―

$

95

$ 62

$

22

$ 56

$

117

$

118

Insurance

―

―

―

―

476

492

476

492

Derivatives

―

2

(4)

3

―

―

(4)

5

Other

―

―

13

2

3

2

16

4

Total Absolute Return

$

―

$ 2

$

104

$ 67

$

501

$ 550

$

605

$

619

Cash and Cash Equivalents

$

161

$ 112

$

32

$ 14

$

―

$ ―

$

193

$

126

Total

$

1,583

$ 1,750

$

3,813

$ 3,340

$

602

$ 667

$

5,998

$

5,757

Other items to reconcile to fair

value of plan assets

$

(41)

$

1

Fair value of plan assets

$

5,957

$

5,758

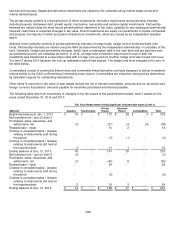

Equities consist primarily of mandates in public equity securities managed to the Morgan Stanley Capital All Country

World Index. Publicly traded equities are valued at the closing price reported in the active market in which the individual

securities are traded.

Fixed Income investments include domestic and foreign government, corporate, mortgage backed and other debt.

Governments, corporate bonds and notes and mortgage backed securities are valued at the closing price reported if

traded on an active market or at yields currently available on comparable securities of issuers with similar credit ratings or

valued under a discounted cash flow approach that maximizes observable inputs, such as current yields of similar

instruments, but includes adjustments for certain risks that may not be observable such as credit and liquidity risks.

Private equity funds consist of both active and passive mandates. Partnership interests are valued using the most recent

general partner statement of fair value, updated for any subsequent partnership interests’ cash flows or expected changes

in fair value. Real estate consists of property funds and REITS (Real Estate Investment Trusts). Property funds are valued

using the most recent partnership statement of fair value, updated for any subsequent partnership interests’ cash flows.

REITS are valued at the closing price reported in the active market in which it is traded.

Absolute return consists of private partnership interests in hedge funds, insurance contracts, derivative instruments,

hedge fund of funds, and bank loan funds. Insurance consists of insurance contracts, which are valued using cash

surrender values which is the amount the plan would receive if the contract was cashed out at year end. Derivative

instruments consist of interest rate swaps that are used to help manage risks. Hedge funds are valued at the NAV as

determined by the independent administrator or custodian of the fund. Generally, hedge fund partnership interests, which

have a redemption right in the near term and are past any lock-up redemption period, are classified as level 2. In 2014, a

hedge fund investment was moved to level 3 after the investment was transferred to a new share class with a longer lock-

up period. Another hedge fund was moved from level 3 to level 2 during 2014 because the lock-up redemption period had

expired.