3M 2014 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

result of changes to the geographic mix of income before taxes, the reinstatement of the U.S. research and development

credit in 2013, an increase in the domestic manufacturer’s deduction benefit, the restoration of tax basis on certain assets

for which depreciation deductions were previously limited, and other items. Combined, these factors decreased the

Company’s effective tax rate by 4.0 percentage points. This benefit was partially offset by factors that increased the

effective tax rate by 3.1 percentage points, which largely related to increases in 3M’s income tax reserves for 2013 when

compared to 2012.

The Company currently expects that its effective tax rate for 2015 will be approximately 28.0 to 29.0 percent, which

assumes that the U.S. research and development credit will be reinstated for 2015. The rate can vary from quarter to

quarter due to discrete items, such as the settlement of income tax audits and changes in tax laws, as well as recurring

factors, such as the geographic mix of income before taxes.

Refer to Note 7 for further discussion of income taxes.

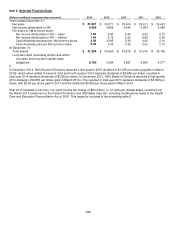

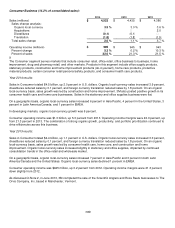

Net Income Attributable to Noncontrolling Interest:

(Millions)

2014

2013

2012

Net income attributable to noncontrolling interest

$

42

$

62

$

67

Net income attributable to noncontrolling interest represents the elimination of the income or loss attributable to non-3M

ownership interests in 3M consolidated entities. The changes in noncontrolling interest amounts have largely related to

Sumitomo 3M Limited (Japan), which was 3M’s most significant consolidated entity with non-3M ownership interests. As

discussed in Note 5, on September 1, 2014, 3M purchased the remaining 25 percent ownership in Sumitomo 3M Limited,

bringing 3M’s ownership to 100 percent. Thus, effective September 1, 2014, net income attributable to noncontrolling

interest was significantly reduced. The primary remaining noncontrolling interest relates to 3M India Limited, of which 3M’s

effective ownership is 75 percent.

Currency Effects:

3M estimates that year-on-year currency effects, including hedging impacts, decreased net income attributable to 3M by

approximately $97 million and $74 million in 2014 and 2013, respectively. These estimates include the effect of translating

profits from local currencies into U.S. dollars; the impact of currency fluctuations on the transfer of goods between 3M

operations in the United States and abroad; and transaction gains and losses, including derivative instruments designed

to reduce foreign currency exchange rate risks and the negative impact of swapping Venezuelan bolivars into U.S. dollars.

3M estimates that year-on-year derivative and other transaction gains and losses increased net income attributable to 3M

by approximately $8 million in 2014 and decreased net income attributable to 3M by approximately $12 million in 2013.

Refer to Note 11 in the Consolidated Financial Statements for additional information concerning 3M’s hedging activities.