3M 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

NOTE 13. Commitments and Contingencies

Capital and Operating Leases:

Rental expense under operating leases was $332 million in 2014, $330 million in 2013 and $300 million in 2012. It is 3M’s

practice to secure renewal rights for leases, thereby giving 3M the right, but not the obligation, to maintain a presence in a

leased facility. 3M has three primary capital leases. First, 3M has a capital lease, which became effective in April 2003,

that involves a building in the United Kingdom (with a lease term of 22 years). During the second quarter of 2003, 3M

recorded a capital lease asset and obligation of approximately 33.5 million British Pound (GBP), or approximately $52

million at December 31, 2014, exchange rates. Second, during the fourth quarter of 2009, 3M recorded a capital lease

asset and obligation of approximately $50 million related to an IT investment with an amortization period of seven years.

Third, in the fourth quarter of 2014, 3M recorded a capital lease asset and obligation of approximately $15 million, which is

discussed in more detail in Note 6.

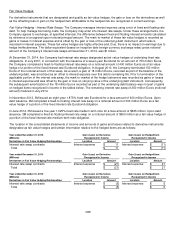

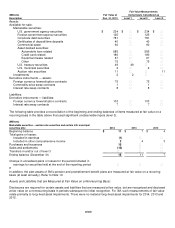

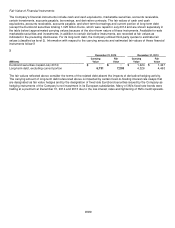

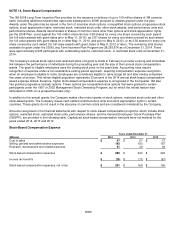

Minimum lease payments under capital and operating leases with non-cancelable terms in excess of one year as of

December 31, 2014, were as follows:

Capital Leases

Operating

Leases

(Millions)

2015 $

11 $

225

2016 11 164

2017 7 126

2018 4 75

2019 3 54

After 2019 37 187

Total $

73 $

831

Less: Amounts representing interest 6

Present value of future minimum lease payments 67

Less: Current obligations under capital leases 8

Long-term obligations under capital leases $

59

Unconditional Purchase Obligations:

Unconditional purchase obligations are defined as an agreement to purchase goods or services that is enforceable and

legally binding (non-cancelable, or cancelable only in certain circumstances). The Company estimates its total

unconditional purchase obligation commitment (for those contracts with terms in excess of one year) as of December 31,

2014, at $489 million. Payments by year are estimated as follows: 2015 ($131 million), 2016 ($139 million), 2017 ($92

million), 2018 ($55 million), 2019 ($34 million) and after 2019 ($38 million). Many of these commitments relate to take or

pay contracts, in which 3M guarantees payment to ensure availability of products or services that are sold to customers.

The Company expects to receive consideration (products or services) for these unconditional purchase obligations. The

purchase obligation amounts do not represent the entire anticipated purchases in the future, but represent only those

items for which the Company is contractually obligated. The majority of 3M’s products and services are purchased as

needed, with no unconditional commitment. For this reason, these amounts will not provide an indication of the

Company’s expected future cash outflows related to purchase obligations.

Warranties/Guarantees:

3M’s accrued product warranty liabilities, recorded on the Consolidated Balance Sheet as part of current and long-term

liabilities, are estimated at approximately $30 million at December 31, 2014, and $31 million at December 31, 2013. 3M

does not consider this amount to be material. The fair value of 3M guarantees of loans with third parties and other

guarantee arrangements are not material.

Related Party Activity:

3M does not have any material related party activity that is not in the ordinary course of business.