3M 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

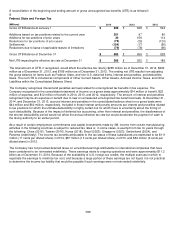

3M reviews impairments associated with its marketable securities in accordance with the measurement guidance provided

by ASC 320, Investments-Debt and Equity Securities, when determining the classification of the impairment as

“temporary” or “other-than-temporary”. A temporary impairment charge results in an unrealized loss being recorded in the

other comprehensive income component of shareholders’ equity. Such an unrealized loss does not reduce net income

attributable to 3M for the applicable accounting period because the loss is not viewed as other-than-temporary. The

factors evaluated to differentiate between temporary and other-than-temporary include the projected future cash flows,

credit ratings actions, and assessment of the credit quality of the underlying collateral, as well as other factors.

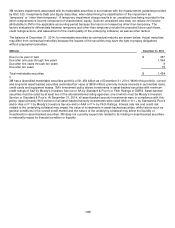

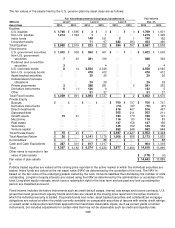

The balance at December 31, 2014, for marketable securities by contractual maturity are shown below. Actual maturities

may differ from contractual maturities because the issuers of the securities may have the right to prepay obligations

without prepayment penalties.

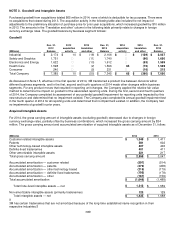

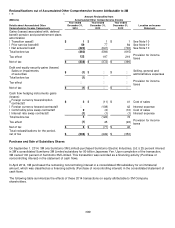

(Millions)

December 31, 2014

Due in one year or less $

367

Due after one year through five years 1,064

Due after five years through ten years 8

Due after ten years 15

Total marketable securities $

1,454

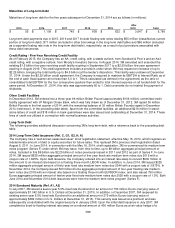

3M has a diversified marketable securities portfolio of $1.454 billion as of December 31, 2014. Within this portfolio, current

and long-term asset-backed securities (estimated fair value of $538 million) primarily include interests in automobile loans,

credit cards and equipment leases. 3M’s investment policy allows investments in asset-backed securities with minimum

credit ratings of Aa2 by Moody’s Investors Service or AA by Standard & Poor’s or Fitch Ratings or DBRS. Asset-backed

securities must be rated by at least two of the aforementioned rating agencies, one of which must be Moody’s Investors

Service or Standard & Poor’s. At December 31, 2014, all asset-backed security investments were in compliance with this

policy. Approximately 96.6 percent of all asset-backed security investments were rated AAA or A-1+ by Standard & Poor’s

and/or Aaa or P-1 by Moody’s Investors Service and/or AAA or F1+ by Fitch Ratings. Interest rate risk and credit risk

related to the underlying collateral may impact the value of investments in asset-backed securities, while factors such as

general conditions in the overall credit market and the nature of the underlying collateral may affect the liquidity of

investments in asset-backed securities. 3M does not currently expect risk related to its holding in asset-backed securities

to materially impact its financial condition or liquidity.