3M 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.84

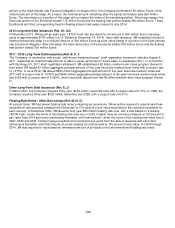

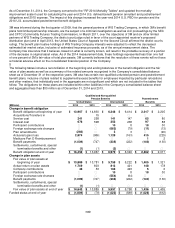

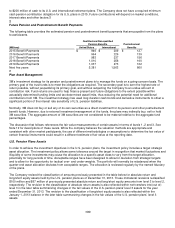

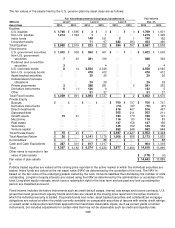

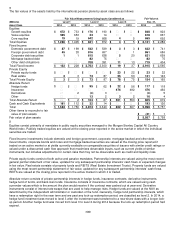

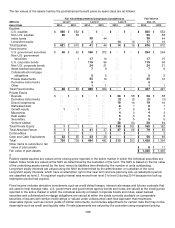

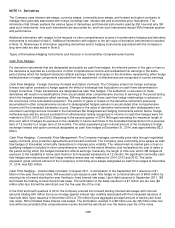

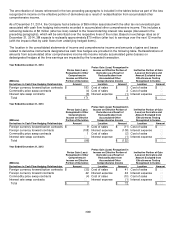

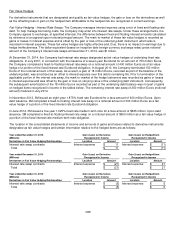

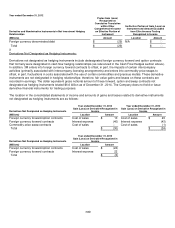

Private placements are valued by the custodian using recognized pricing services and sources. Swaps and derivative

instruments are valued by the custodian using closing market swap curves and market derived inputs.

The private equity portfolio is a diversified mix of direct investments, derivative instruments and partnership interests

including buyouts, distressed debt, growth equity, mezzanine, real estate and venture capital investments. Partnership

interests are valued using the most recent general partner statement of fair value, updated for any subsequent partnership

interests’ cash flows or expected changes in fair value. Direct investments are equity co-investments in private companies

and projects, the majority of which are power infrastructure investments, which are valued by an independent valuation

agent.

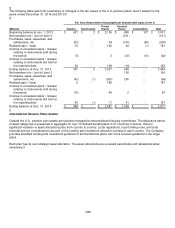

Absolute return consists primarily of private partnership interests in hedge funds, hedge fund of funds and bank loan

funds. Partnership interests are valued using the NAV as determined by the administrator or custodian of the fund.

Generally, hedge fund partnership interests, which have a redemption right in the near term and are past any lock-up

redemption period, are classified as level 2. A hedge fund investment was moved from level 3 to level 2 during 2013

because the lock-up redemption period had expired. A hedge fund investment was moved to level 3 during 2014 after the

investment was transferred to a new share class with a longer lock-up period.

Commodities consist of commodity-linked notes and commodity-linked derivative contracts designed to deliver investment

returns similar to the Goldman Sachs Commodities Index (GSCI) or Bloomberg Commodity index returns. Commodities

are valued at closing prices determined by calculation agents for outstanding transactions.

Other items to reconcile to fair value of plan assets include the net of insurance receivables for WG Trading Company,

interest receivables, amounts due for securities sold, amounts payable for securities purchased and interest payable.