3M 2014 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

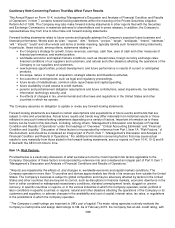

selling price increases contributing 0.7 percent. Acquisitions added 0.1 percent to sales, which related to the April 2014

acquisition of Treo Solutions LLC (Treo). Foreign currency translation reduced sales by 4.4 percent year-on-year.

From a geographic area perspective, fourth-quarter 2014 organic local-currency sales growth was 9.0 percent in Latin

America/Canada, 6.9 percent in Asia Pacific, 6.6 percent in the United States, and 3.3 percent in EMEA. Organic local-

currency sales growth in Latin America/Canada was led by Electronics and Energy, Health Care, and Safety and

Graphics. Mexico delivered strong growth and Brazil was up slightly. Organic local-currency sales growth in Asia Pacific

was led by Safety and Graphics, and Health Care. Sales in Japan grew 9 percent organically, or 4 percent excluding

electronics. China/Hong Kong sales grew 4 percent organically, or 6 percent excluding electronics. Organic local-currency

sales growth in the United States was strong in four of the five business segments, while Electronics and Energy was flat.

Organic local-currency sales growth in EMEA was positive in four of five business segments, led by Safety and Graphics,

and Electronics and Energy, while Consumer was down slightly in the quarter. Central/East Europe and Middle

East/Africa each showed solid local-currency sales growth in the quarter, while West Europe grew 1 percent. EMEA

economies remain soft, but 3M is managing the situation by growing market positions and driving continuous productivity

across the region.

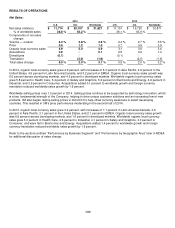

Operating income in the fourth quarter of 2014 was 21.5 percent of sales, compared to 20.9 percent of sales in the fourth

quarter of 2013, an increase of 0.6 percentage points. These results included a benefit from the combination of selling

price increases and raw material cost decreases, lower pension/postretirement benefit costs, and profit leverage on

organic volume growth. These factors were partially offset by strategic investments, and other factors. Strategic

investments are further described for year 2014 in the section entitled “Results of Operations”.

The income tax rate was 28.0 percent in the fourth quarter of 2014, down 0.4 percentage points versus the fourth quarter

of 2013, which increased earnings per diluted share by approximately 1 cent. Weighted-average diluted shares

outstanding in the fourth quarter of 2014 declined 4.5 percent year-on-year to 650.9 million, which increased earnings per

diluted share by approximately 8 cents. Foreign exchange impacts decreased earnings per diluted share by approximately

5 cents.

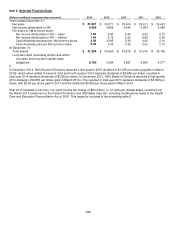

Year 2014 results:

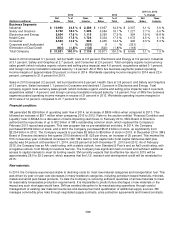

For total year 2014, net income attributable to 3M was $4.956 billion, or $7.49 per diluted share, compared to $4.659

billion, or $6.72 per diluted share, in 2013, an increase of 11.5 percent on a per diluted share basis. Sales totaled $31.8

billion, an increase of 3.1 percent from 2013. From a business segment perspective, organic local-currency sales growth

was 5.8 percent in Health Care, 5.4 percent in Safety and Graphics, 5.2 percent in Electronics and Energy, 4.9 percent in

Industrial, and 3.9 percent in Consumer. From a geographic area perspective, 2014 organic local-currency sales growth

was 6.3 percent in Asia Pacific, 4.9 percent in the United States, 4.5 percent in Latin America/Canada, and 3.2 percent in

EMEA. For the Company in total, organic local-currency sales grew 4.9 percent, with higher organic volumes contributing

3.9 percent and selling price increases contributing 1.0 percent. Acquisitions added 0.1 percent to sales, driven by the

Treo acquisition discussed above. Foreign currency translation reduced sales by 1.9 percent year-on-year.

Operating income in 2014 was 22.4 percent of sales, compared to 21.6 percent of sales in 2013, an increase of 0.8

percentage points. These results included a benefit from the combination of selling price increases and raw material cost

decreases, lower pension/postretirement benefit costs, and profit leverage on organic volume growth. These factors were

partially offset by strategic investments and other factors. Refer to the section entitled “Results of Operations” for further

discussion.

The income tax rate was 28.9 percent in 2014, up 0.8 percentage points versus 2013, which decreased earnings per

diluted share by approximately 8 cents. Weighted-average diluted shares outstanding in 2014 declined 4.6 percent year-

on-year to 662.0 million, which increased earnings per diluted share by approximately 34 cents. Foreign exchange

impacts decreased earnings per diluted share by approximately 15 cents.

Fourth quarter of 2013 results:

Fourth-quarter 2013 net income attributable to 3M was $1.103 billion, or $1.62 per diluted share, compared to $991

million, or $1.41 per diluted share, in the fourth quarter of 2012. Fourth-quarter 2013 sales totaled $7.6 billion, an increase

of 2.4 percent from the fourth quarter of 2012. 3M achieved organic local-currency sales growth (which includes organic

volume and selling price impacts) in all five of its business segments, led by Industrial. Industrial organic local-currency

sales increased 5.8 percent, led by advanced materials, automotive OEM, 3M Purification Inc. (filtration products),

aerospace and commercial transportation, and automotive aftermarket. Organic local-currency sales increased 4.7

percent in Safety and Graphics, led by roofing granules, personal safety, and commercial solutions. Organic local-