3M 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.77

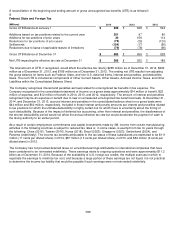

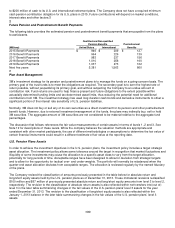

NOTE 10. Pension and Postretirement Benefit Plans

3M has company-sponsored retirement plans covering substantially all U.S. employees and many employees outside the

United States. In total, 3M has over 80 defined benefit plans in 28 countries. Pension benefits associated with these plans

generally are based on each participant’s years of service, compensation, and age at retirement or termination. The

primary U.S. defined-benefit pension plan was closed to new participants effective January 1, 2009. The Company also

provides certain postretirement health care and life insurance benefits for substantially all of its U.S. employees who reach

retirement age while employed by the Company. Most international employees and retirees are covered by government

health care programs. The cost of company-provided postretirement health care plans for international employees is not

material and is combined with U.S. amounts in the tables that follow.

The Company also sponsors employee savings plans under Section 401(k) of the Internal Revenue Code. These plans

are offered to substantially all regular U.S. employees. For eligible employees hired prior to January 1, 2009, employee

401(k) contributions of up to 6% of eligible compensation are matched in cash at rates of 60% or 75%, depending on the

plan in which the employee participates. Employees hired on or after January 1, 2009, receive a cash match of 100% for

employee 401(k) contributions of up to 6% of eligible compensation and also receive an employer retirement income

account cash contribution of 3% of the participant’s total eligible compensation. All contributions are invested in a number

of investment funds pursuant to the employees’ elections. Employer contributions to the U.S. defined contribution plans

were $153 million, $136 million and $124 million for 2014, 2013 and 2012, respectively. 3M subsidiaries in various

international countries also participate in defined contribution plans. Employer contributions to the international defined

contribution plans were $75 million, $71 million and $58 million for 2014, 2013 and 2012, respectively.

The Company has made deposits for its defined benefit plans with independent trustees. Trust funds and deposits with

insurance companies are maintained to provide pension benefits to plan participants and their beneficiaries. There are no

plan assets in the non-qualified plan due to its nature. For its U.S. postretirement health care and life insurance benefit

plans, the Company has set aside amounts at least equal to annual benefit payments with an independent trustee.

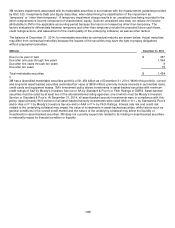

In August 2006, the Pension Protection Act (PPA) was signed into law in the U.S. The PPA transition rules increased the

funding target for defined benefit pension plans to 100% of the target liability by 2011. 3M’s primary U.S. qualified defined

benefit plan does not have a mandatory cash contribution because the Company has a significant credit balance from

previous discretionary contributions that can be applied to any PPA funding requirements.

In the fourth quarter of 2010, the Company made further changes to its U.S. postretirement health care benefit plans. As a

result of these changes, the Company will transition all current and future retirees to the savings account benefits-based

plan announced in 2008. These changes became effective beginning January 1, 2013, for all Medicare eligible retirees

and their Medicare eligible dependents and will become effective beginning January 1, 2016, for all non-Medicare eligible

retirees and their eligible dependents.

In December 2011, the Company offered a voluntary early retirement incentive program to certain eligible participants of

its U.S. pension plans who met age and years of pension service requirements. The eligible participants who accepted the

offer and retired on February 1, 2012, received an enhanced pension benefit. Pension benefits were enhanced by adding

one additional year of pension service and one additional year of age for certain benefit calculations. 616 participants

accepted the offer and retired on February 1, 2012. As a result, the Company incurred a $26 million charge related to

these special termination benefits in the first quarter of 2012.

Effective July 1, 2012, 3M Canada closed its pension plans for salaried employees to new participants. The change did

not trigger a plan remeasurement and therefore there was no immediate impact to the liability and expense.

In the third quarter of 2014, former U.S. employees who have a pension benefit for which they have not begun receiving

payment (term vested) were offered a lump sum payout of their pension benefit. As a result of this action, the projected

benefit obligation (PBO) liability was reduced in the fourth quarter of 2014 by approximately $270 million, with the actual

cash payout of approximately the same amount paid from the plan’s assets in the fourth quarter of 2014. The PBO liability

reduction was 34% of the term vested eligible PBO and a 2% reduction in the overall U.S. pension PBO liability based on

the December 31, 2013, valuation. There was no pension expense impact as a result of this action on 3M’s consolidated

statement of income in 2014.

In the fourth quarter of 2014, 3M’s Board of Directors approved an amendment of the U.S. defined benefit pension plan to

include a lump sum payment option for employees that have vested retirement benefits who commence their pension

January 1, 2015, or later. This option is also available to vested employees who leave 3M before becoming eligible to

retire at the time of termination. This change reduced 3M’s year-end 2014 PBO liability by approximately $266 million.