3M 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 3M annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

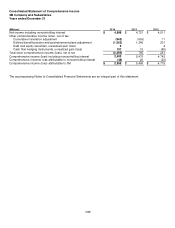

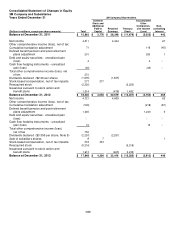

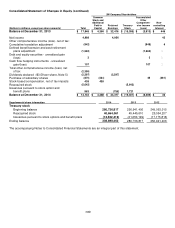

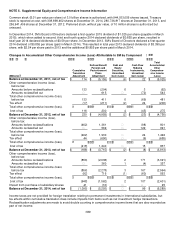

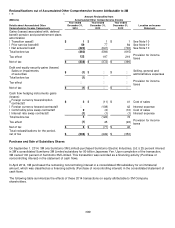

Comprehensive income: Total comprehensive income and the components of accumulated other comprehensive income

(loss) are presented in the Consolidated Statement of Comprehensive Income and the Consolidated Statement of

Changes in Equity. Accumulated other comprehensive income (loss) is composed of foreign currency translation effects

(including hedges of net investments in international companies), defined benefit pension and postretirement plan

adjustments, unrealized gains and losses on available-for-sale debt and equity securities, and unrealized gains and

losses on cash flow hedging instruments.

Derivatives and hedging activities: All derivative instruments within the scope of ASC 815, Derivatives and Hedging, are

recorded on the balance sheet at fair value. The Company uses interest rate swaps, currency and commodity price

swaps, and foreign currency forward and option contracts to manage risks generally associated with foreign exchange

rate, interest rate and commodity market volatility. All hedging instruments that qualify for hedge accounting are

designated and effective as hedges, in accordance with U.S. generally accepted accounting principles. If the underlying

hedged transaction ceases to exist, all changes in fair value of the related derivatives that have not been settled are

recognized in current earnings. Instruments that do not qualify for hedge accounting are marked to market with changes

recognized in current earnings. Cash flows from derivative instruments are classified in the statement of cash flows in the

same category as the cash flows from the items subject to designated hedge or undesignated (economic) hedge

relationships. The Company does not hold or issue derivative financial instruments for trading purposes and is not a party

to leveraged derivatives.

Credit risk: The Company is exposed to credit loss in the event of nonperformance by counterparties in interest rate

swaps, currency swaps, commodity price swaps, and forward and option contracts. However, the Company’s risk is

limited to the fair value of the instruments. The Company actively monitors its exposure to credit risk through the use of

credit approvals and credit limits, and by selecting major international banks and financial institutions as counterparties.

3M enters into master netting arrangements with counterparties when possible to mitigate credit risk in derivative

transactions. A master netting arrangement may allow each counterparty to net settle amounts owed between a 3M entity

and the counterparty as a result of multiple, separate derivative transactions. The Company does not anticipate

nonperformance by any of these counterparties. 3M has elected to present the fair value of derivative assets and liabilities

within the Company’s consolidated balance sheet on a gross basis even when derivative transactions are subject to

master netting arrangements and may otherwise qualify for net presentation.

Fair value measurements: 3M follows ASC 820, Fair Value Measurements and Disclosures, with respect to assets and

liabilities that are measured at fair value on a recurring basis and nonrecurring basis. Under the standard, fair value is

defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants as of the measurement date. The standard also establishes a hierarchy for inputs

used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs

by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants

would use in valuing the asset or liability developed based on market data obtained from sources independent of the

Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors market participants

would use in valuing the asset or liability developed based upon the best information available in the circumstances. The

hierarchy is broken down into three levels. Level 1 inputs are quoted prices (unadjusted) in active markets for identical

assets or liabilities. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for

identical or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) that are

observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the asset or

liability. Categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair

value measurement.

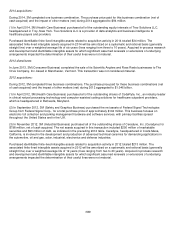

Acquisitions: The Company accounts for business acquisitions in accordance with ASC 805, Business Combinations. This

standard requires the acquiring entity in a business combination to recognize all (and only) the assets acquired and

liabilities assumed in the transaction and establishes the acquisition-date fair value as the measurement objective for all

assets acquired and liabilities assumed in a business combination. Certain provisions of this standard prescribe, among

other things, the determination of acquisition-date fair value of consideration paid in a business combination (including

contingent consideration) and the exclusion of transaction and acquisition-related restructuring costs from acquisition

accounting.

New Accounting Pronouncements

In March 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2013-

05, Parent’s Accounting for the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups

of Assets within a Foreign Entity or of an Investment in a Foreign Entity. This standard provides additional guidance with

respect to the reclassification into income of the cumulative translation adjustment (CTA) recorded in accumulated other