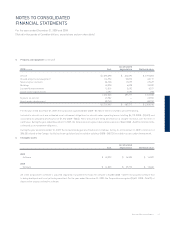

Westjet 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 WestJet 2009 Annual Report

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

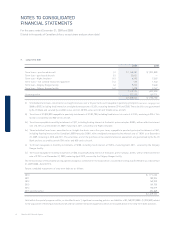

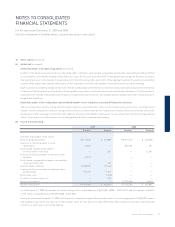

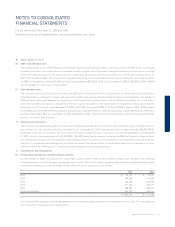

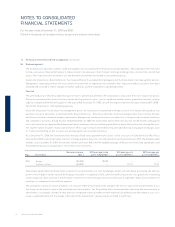

9. Income taxes (continued)

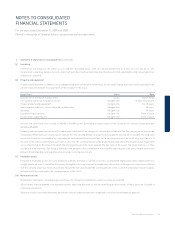

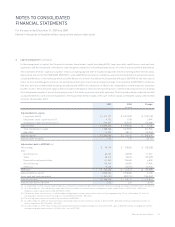

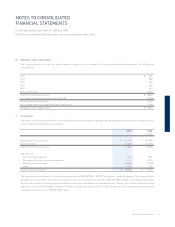

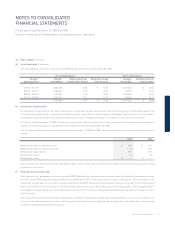

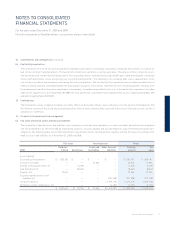

The components of the net future tax liability are as follows:

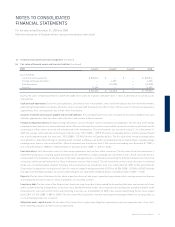

The Corporation has recognized a benefi t on $188,474 (2008 – $314,384) of non-capital losses which are available for carryforward to reduce

taxable income in future years. These losses will begin to expire in 2014. The Corporation has also recognized a benefi t of $9,376 (2008 – $6,748)

for unused corporate minimum tax credits which are available for carryforward to reduce Ontario taxable income in future years. These credits

will begin to expire in 2013.

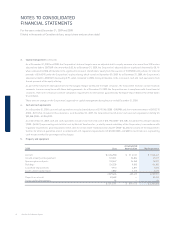

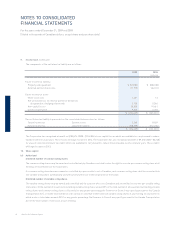

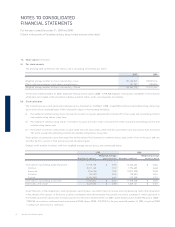

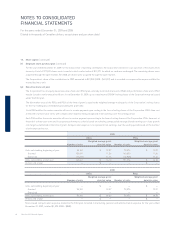

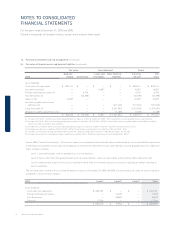

10. Share capital

(a) Authorized

Unlimited number of common voting shares

The common voting shares may be owned and controlled only by Canadians and shall confer the right to one vote per common voting share at all

meetings of shareholders of the Corporation.

If a common voting share becomes owned or controlled by a person who is not a Canadian, such common voting share shall be converted into

one variable voting share automatically and without any further act of the Corporation or the holder.

Unlimited number of variable voting shares

The variable voting shares may be owned and controlled only by a person who is not Canadian and are entitled to one vote per variable voting

share unless (i) the number of issued and outstanding variable voting shares exceed 25% of the total number of all issued and outstanding variable

voting shares and common voting shares collectively (or any greater percentage the Governor in Council may specify pursuant to the Canada

Transportation Act), or (ii) the total number of votes cast by or on behalf of the holders of variable voting shares at any meeting on any matter on

which a vote is to be taken exceeds 25% (or any greater percentage the Governor in Council may specify pursuant to the Canada Transportation

Act) of the total number of votes cast at such meeting.

2009 2008

Restated

Future income tax liability:

Property and equipment $ (327,783) $ (308,108)

Deferred partnership income (11,913) (34,741)

Future income tax asset:

Share issue costs 1,561 13

Net unrealized loss on effective portion of derivatives

designated in a hedging relationship 2,120 11,346

Non-capital losses 50,200 91,461

Credit carryforwards 9,376 6,748

$ (276,439) $ (233,281)

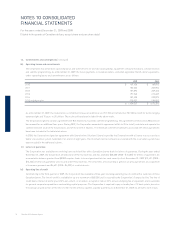

The net future tax liability is presented on the consolidated balance sheet as follows:

Future income tax Current assets 2,560 8,459

Future income tax Long-term liability (278,999) (241,740)

$ (276,439) $ (233,281)