Westjet 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 11

cent to 3.37 cents in the fourth quarter of 2009, as compared to

4.14 cents in the same period of 2008. Our fourth quarter fuel

costs, excluding hedging, were $0.67 per litre, which differs from

our previously disclosed estimate of a range between $0.69 and

$0.71 per litre due to lower-than-forecasted US-dollar West

Texas Intermediate (WTI) crude oil prices.

Marketing, general and administration

Marketing encompasses a wide variety of expenses, including

advertising and promotions, onboard products, live satellite

television licensing fees and catering. General and administration

costs consist of our corporate offi ce departments, professional

fees, insurance costs and transaction costs related to aircraft

acquisitions. During the fourth quarter of 2009, our marketing,

general and administration charge per ASM decreased by 12.7

per cent to 1.24 cents, compared to 1.42 cents in the same period

of 2008. This decrease was attributable mainly to higher costs

during the fourth quarter of 2008, as a result of a $4.3 million

payment incurred for the expiration of our previous reservation

system, as well as lower costs due to the discontinuation of

the sponsorship agreement with AIR MILES, which ended

our sponsorship in the AIR MILES Reward Program at the

end of 2008.

Sales and distribution

Commissions paid to travel agents and credit card fees comprise

a signifi cant portion of our sales and distribution expense. During

the fourth quarter of 2009, our sales and distribution expense per

ASM increased to 1.14 cents, up by 20.0 per cent from 0.95 cents in

the same quarter of 2008. This variance was primarily attributable

to higher travel agency commissions related to WestJet Vacations,

due to increased sales as a result of additional destinations over

the prior year, as well as WestJet Vacations sales growth through

increased distribution channels as a result of the implementation

of a new WestJet Vacations reservation system. Additionally, as

at December 31, 2009, we determined that $2.4 million of our

accounts receivable balance relating to our cargo operations was

doubtful due to a dispute with our cargo service provider. As a

result, we recorded a bad debt provision for this amount, refl ected

in the sales and distribution expense line item. The agreement with

the cargo service provider has since been terminated, and, as of

January 11, 2010, we have a new cargo service provider in place.

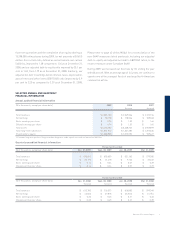

Revenue

During the quarter ended December 31, 2009, total revenues

decreased by 7.4 per cent to $570.0 million from $615.8 million

in the same period of 2008, largely attributable to the continued

weak economy. Our RASM decreased by 10.0 per cent for the

fourth quarter of 2009 to 12.92 cents, compared to 14.36 cents

in 2008. This change related primarily to a decline in yield of 11.0

per cent for the fourth quarter of 2009. The decrease in yield was

attributable to an increase in the practice of fare discounting

to stimulate air travel. Similarly, guest revenues from our

scheduled fl ight operations declined by 5.9 per cent during the

fourth quarter to $528.1 million, as compared to $561.5 million in

the fourth quarter of 2008. This decline was mitigated somewhat

by growth in WestJet Vacations air revenue, which is included

in guest revenues. For the fourth quarter of 2009, charter and

other revenues, which include charter, cargo, ancillary, WestJet

Vacations non-air and other revenue, decreased by 22.7 per

cent to $41.9 million. This decline was driven mainly by the

termination of our charter agreement with Transat, effective May

10, 2009, in favour of fl ying our own scheduled service to existing

and new sun destinations.

Expenses

For the fourth quarter of 2009, our CASM decreased by 6.8 per

cent as compared to the same quarter of 2008, due largely to

declines in aircraft fuel expense and marketing, general and

administration expense, offset somewhat by an increase in

sales and distribution expense. Our CASM, excluding fuel and

employee profi t share, remained relatively fl at at 8.67 cents.

Aircraft fuel

For the fourth quarter of 2009, year-over-year jet fuel prices

have stabilized from their previously elevated levels. As such,

we did not see the same substantial relief on costs during the

fourth quarter of 2009 as we did in the fi rst nine months of

the year. The average market price for jet fuel was US $84 per

barrel in the fourth quarter of 2009, versus US $79 per barrel

in the fourth quarter of 2008, representing an increase of 6.3

per cent. However, due to lower year-over-year refi ning costs

and a stronger Canadian dollar in the fourth quarter of 2009,

Canadian jet fuel prices declined during the quarter. We saw a

corresponding decrease in our fuel costs per ASM of 18.6 per