Westjet 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 WestJet 2009 Annual Report

the beginning of the fi rst annual reporting period beginning on

or after January 1, 2011. Early adoption is permitted. We elected

to adopt Section 1601 and Section 1602 prospectively, effective

January 1, 2009. Adoption of these sections did not impact our

results of operations or fi nancial position.

Financial instruments

In May 2009, the CICA amended Section 3862, Financial

Instruments – Disclosures, to improve disclosure requirements

about fair value measurement for fi nancial instruments and

liquidity risk disclosures. These amendments require a three-

level hierarchy that refl ects the signifi cance of the inputs used

in making the fair value measurements. Fair values of assets

and liabilities included in level 1 are determined by reference to

quoted prices in active markets for identical assets and liabilities.

Assets and liabilities in level 2 include valuations using inputs

other than quoted prices for which all signifi cant outputs are

observable, either directly or indirectly. Level 3 valuations are

based on inputs that are unobservable and signifi cant to the

overall fair value measurement. Please refer to the consolidated

fi nancial statements and notes for the years ended December

31, 2009 and 2008, for further disclosure.

Business combinations

In January 2009, the CICA Accounting Standards Board (AcSB)

issued Section 1582, Business Combinations. Section 1582

replaces Section 1581, Business Combinations, and harmonizes

the Canadian standards with IFRS. Section 1582 establishes

principles and requirements of the acquisition method for

business combinations and related disclosures. This section is

effective January 1, 2011, and applies prospectively to business

combinations for which the acquisition date is on or after our fi rst

annual reporting period beginning on or after January 1, 2011.

Early adoption is permitted. We elected to adopt Section 1582

prospectively, effective January 1, 2009. Adoption of this section

did not impact our results of operations or fi nancial position.

Consolidated statements and non-controlling interests

In January 2009, the AcSB issued Sections 1601, Consolidated

Financial Statements, and Section 1602, Non-controlling

Interests, which together replace Section 1600, Consolidated

Financial Statements and harmonize the Canadian standards

with IFRS. Section 1601 establishes standards for the preparation

of consolidated fi nancial statements. Section 1602 provides

guidance on accounting for a non-controlling interest in a

subsidiary in consolidated fi nancial statements subsequent to

a business combination. These sections are effective on or after

December 31, 2008

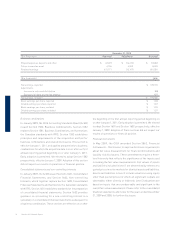

($ in thousands) Reported Adjustment Restated

Prepaid expenses, deposits and other $ 67,693 $ (14,410) $ 53,283

Future income tax asset 4,196 4,263 8,459

Retained earnings 611,171 (10,147) 601,024

($ in thousands) 2008

Net earnings, reported $ 178,135

Adjustments:

Increase in sales and distribution (88)

Decrease in future income tax expense 459

Net earnings, restated $ 178,506

Basic earnings per share, reported $ 1.38

Diluted earnings per share, reported $ 1.37

Basic earnings per share, restated $ 1.39

Diluted earnings per share, restated $ 1.37