Westjet 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8 WestJet 2009 Annual Report

as compared to a $30.6 million gain in 2008. We also produced

an operating margin of 9.2 per cent, compared to 11.5 per cent

in the prior year.

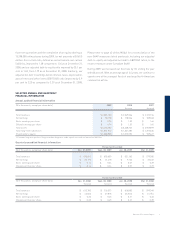

Our load factor was down slightly by 1.4 points to 78.7 per cent

in 2009, from 80.1 per cent in 2008. Despite the decline, our load

factor for 2009 remained within our optimal operating range of

78 per cent to 82 per cent. Our quarterly load factors for the past

eight quarters are depicted below.

form of utilization management, renegotiations with our key

strategic suppliers and voluntary employee programs.

For the year ended December 31, 2009, our CASM improved by

10.6 per cent to 11.77 cents from 13.17 cents in 2008, mainly

attributable to lower fuel costs year over year. Excluding fuel and

employee profi t share, our CASM increased to 8.45 cents from

8.29 cents in 2008, representing an increase of 1.9 per cent over

2008. These changes were due mainly to incremental aircraft

leasing and maintenance costs, lower aircraft utilization and a

weaker Canadian dollar.

We maintained one of the strongest balance sheets in the North

American airline industry during 2009, as evidenced by our

signifi cant cash balance of $1,005.2 million as at December

31, 2009, an increase of 22.6 per cent from December 31, 2008.

The increase in our cash position was a result of positive cash

Given the challenges the airline industry faced this year, we are

pleased with our fi nancial results. We reported net earnings of

$98.2 million and diluted earnings per share of $0.74. Adjusted

for a non-recurring net future income tax reduction in 2009,

our net earnings were $93.1 million and diluted earnings per

share were $0.71. Additionally, our earnings in the year were

negatively impacted by non-operating items, including lower

interest income and a loss on foreign exchange of $12.3 million,

During the fourth quarter of 2009, we launched our largest-

ever seasonal non-stop fl ight schedule, featuring a record eight

new sun destinations and three additional U.S. destinations

for our winter schedule. Beginning in the fall of 2009, WestJet

and WestJet Vacations launched seasonal non-stop service to

Varadero, Holguin and Cayo Coco, Cuba; Ixtapa and Cozumel,

Mexico; St. Martin; Providenciales, Turks and Caicos; Freeport,

Bahamas; Lihue (Kauai), Hawaii; Miami, Florida; and Atlantic

City, New Jersey. In addition to these destinations, we also

launched service to Yellowknife, Sydney, San Diego and San

Francisco during the year. Recently, we announced seasonal non-

stop service to Kindley Field, Bermuda and Samana, Dominican

Republic, to commence in May and June 2010, respectively.

To help partially offset the decline we have seen in RASM, cost

control remains a key priority. During the year, we identifi ed

sustainable savings, cost deferrals and cost avoidances in the

Quarterly load factor

85%

80%

75%

70%

2008 Q1 2008 Q2 2008 Q3 2008 Q4 2009 Q1 2009 Q2 2009 Q3 2009 Q4