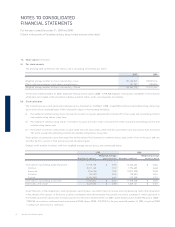

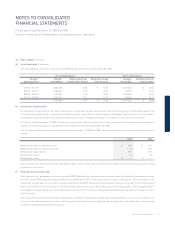

Westjet 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 61

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

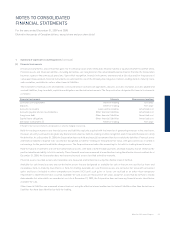

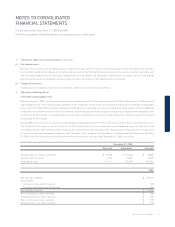

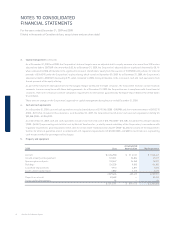

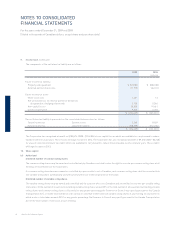

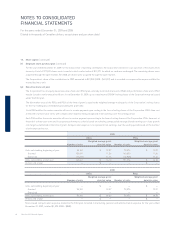

5. Property and equipment (continued)

For the year ended December 31, 2009, the Corporation capitalized $nil (2008 – $2,132) of interest related to aircraft fi nancing.

Included in aircraft costs are estimated asset retirement obligations for aircraft under operating leases totalling $4,710 (2008 – $3,493) and

associated accumulated amortization of $1,314 (2008 – $846). These amounts are being amortized on a straight-line basis over the term of

each lease. During the year ended December 31, 2009, the Corporation recognized depreciation expense of $468 (2008 – $407) in relation to the

estimated asset retirement obligations.

During the year ended December 31, 2009, the Corporation began amortization of its Campus facility. As at December 31, 2009, a total cost of

$96,081 related to the Campus facility has been capitalized and included in buildings (2008 – $80,725 included in assets under development).

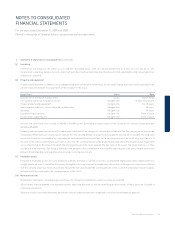

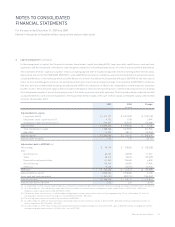

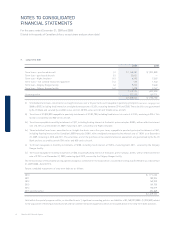

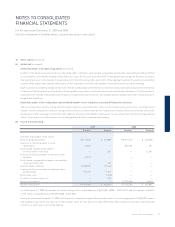

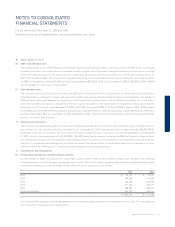

6. Intangible assets

All of the Corporation’s software is acquired separately. Included in the totals for software is $4,085 (2008 – $1,591) for acquired software that

is being developed and is not yet being amortized. For the year ended December 31, 2009, the Corporation recognized $5,601 (2008 – $4,675) of

depreciation expense related to software.

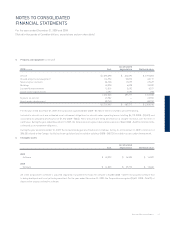

2008 Restated Cost

Accumulated

depreciation Net book value

Aircraft $ 2,394,098 $ 402,095 $ 1,992,003

Ground property and equipment 116,990 53,873 63,117

Spare engines and parts 86,728 17,099 69,629

Buildings 40,028 6,828 33,200

Leasehold improvements 12,019 5,692 6,327

Assets under capital leases 2,482 1,690 792

2,652,345 487,277 2,165,068

Deposits on aircraft 23,982 — 23,982

Assets under development 80,740 — 80,740

$ 2,757,067 $ 487,277 $ 2,269,790

Cost

Accumulated

depreciation Net book value

2009

Software $ 40,392 $ 26,305 $ 14,087

2008

Software $ 41,835 $ 29,775 $ 12,060