Westjet 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 33

hedging relationship is determined using inputs, including

quoted forward prices for commodities, foreign exchange rates

and interest rates, which can be observed or corroborated in

the marketplace. The fair value of the fi xed swap agreements is

estimated by discounting the difference between the contractual

strike price and the current forward price. The fair value of the

costless collar structures is estimated by the use of a standard

option valuation technique.

Ineffectiveness is inherent in hedging jet fuel with derivative

instruments in other commodities, such as crude oil, particularly

given the signifi cant volatility observed in the market on crude

oil and related products. Due to this volatility, we are unable to

predict the amount of ineffectiveness for each period. This may

result in increased volatility in our results.

Change in accounting policies

Goodwill and intangible assets

Effective January 1, 2009, we adopted the Canadian Institute of

Chartered Accountants (CICA) Handbook Section 3064, Goodwill

and Intangible Assets. This section provides guidance on the

recognition, measurement, presentation and disclosure for goodwill

and intangible assets, other than the initial recognition of goodwill or

intangible assets acquired in a business combination. Upon adoption

of Section 3064, we reclassifi ed the net book value of purchased

software that was previously recognized in property and equipment

to intangible assets as shown on our consolidated balance sheet.

Prior-period balances were reclassifi ed. There was no impact to

current or prior-period net earnings for this change. Software is

carried at cost less accumulated depreciation and is amortized on

a straight-line basis over its useful life of fi ve years. Please refer to

the consolidated fi nancial statements and notes for the years ended

December 31, 2009 and 2008, for further disclosure.

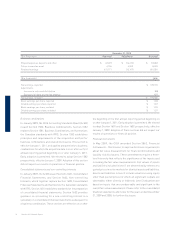

During 2009, we changed our accounting policy regarding the treatment

of certain sales and distribution, and marketing costs. We now expense

these costs as incurred. Previously these costs were deferred in prepaid

expenses, deposits and other on the consolidated balance sheet and

expensed in the period the related revenue was recognized. The change in

accounting policy has been accounted for retrospectively with restatement

of the prior year. The effect of this change to our consolidated balance

sheet as at December 31, 2008, and to the consolidated statement

of earnings for the year ended December 31, 2008, is as follows:

of assets and liabilities, calculated using the currently enacted

or substantively enacted tax rates anticipated to apply in the

period that the temporary differences are expected to reverse.

Future income tax infl ows and outfl ows are subject to estimation

in terms of both timing and amount of future taxable earnings.

Should these estimates change, the carrying value of income tax

assets or liabilities may change.

Stock-based compensation expense

Grants under our stock-based compensation plans are

accounted for in accordance with the fair-value-based method of

accounting. For stock-based compensation plans that will settle

through the issuance of equity, the fair value of the option or unit

is determined on the grant date using a valuation model and

recorded as compensation expense over the period that the stock

option or unit vests, with a corresponding increase to contributed

surplus. The fair value of stock options is estimated on the

date of grant using the Black-Scholes option pricing model,

and the fair value of our other equity-based share unit plans is

determined based on the market value of our common shares

on the date of the grant. Upon the exercise of stock options or

units, consideration received, together with amounts previously

recorded in contributed surplus, are recorded as an increase

in share capital. The Black-Scholes option pricing model was

developed for use in estimating the fair value of short-term

traded options that have no vesting restrictions and are fully

transferable. In addition, option valuation models require the

input of somewhat subjective assumptions, including expected

share price volatility.

Valuation of derivative financial instruments

The fair values of derivative fi nancial instruments are calculated

on the basis of information available at the balance sheet date.

The fair value of the foreign exchange forward contracts is

measured based on the difference between the contracted rate

and the current forward price obtained from the counterparty,

which can be observed and corroborated in the marketplace.

The fair value of the foreign exchange option arrangements is

determined through a standard option valuation technique used

by the counterparty based on inputs, including foreign exchange

rates, interest rates and volatilities.

The fair value of the fuel derivatives designated in an effective