Westjet 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2009 Annual Report 55

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

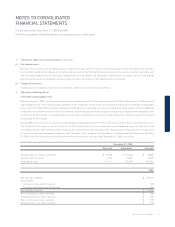

1. Summary of signifi cant accounting policies (continued)

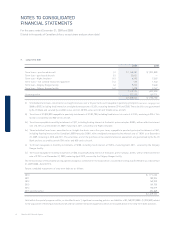

(j) Inventory

Inventories are valued at the lower of cost and net realizable value, with cost being determined on a first-in, first-out basis. The

Corporation’s inventory balance consists of aircraft fuel, de-icing fl uid and retail merchandise. Aircraft expendables and consumables are

expensed as acquired.

(k) Property and equipment

Property and equipment is stated at cost and depreciated to its estimated residual value. Assets under capital lease are initially recorded at the

present value of minimum lease payments at the inception of the lease.

Aircraft are amortized over a range of 30,000 to 50,000 cycles. Estimated residual values of the Corporation’s aircraft range between

$4,000 and $6,000.

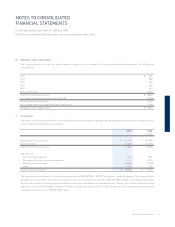

Property and equipment are reviewed for impairment when events or changes in circumstances indicate that the carrying value may not be

recoverable. When events or circumstances indicate that the carrying amount of property and equipment may not be recoverable, the long-lived

assets are tested for recoverability by comparing the undiscounted future cash fl ows to the carrying amount of the asset or group of assets. If

the total of the undiscounted future cash fl ows is less than the carrying amount of the property and equipment, the amount of any impairment

loss is determined as the amount by which the carrying amount of the asset exceeds the fair value of the asset. The impairment loss is then

recognized in net earnings. Fair value is defi ned as the amount of the consideration that would be agreed upon in an arm’s-length transaction

between knowledgeable, willing parties who are under no compulsion to act.

(l) Intangible assets

Included in intangible assets are costs related to software. Software is carried at cost less accumulated depreciation and is depreciated on a

straight-line basis over its useful life of fi ve years. Intangible assets are reviewed for impairment when events or changes in circumstances indicate

that the carrying value may not be recoverable. Should the fair value exceed the carrying amount of the asset, the Corporation would recognize

an impairment loss and reduce the carrying amount to fair value.

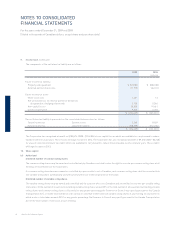

(m) Maintenance costs

Maintenance and repairs, including major overhauls, are charged to maintenance expense as they are incurred.

Aircraft parts that are deemed to be beyond economic repair are disposed of, and the remaining net book values of these parts are included in

maintenance expense.

Recovery of costs associated with parts and labour covered under warranty are recognized as an offset to maintenance expense.

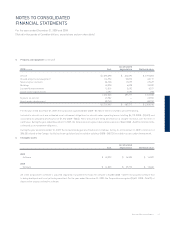

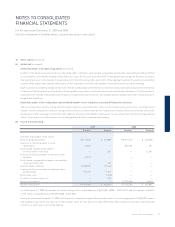

Asset class Basis Rate

Aircraft, net of estimated residual value Cycles Cycles fl own

Live satellite television included in aircraft Straight-line 10 years/lease term

Ground property and equipment Straight-line 3 to 25 years

Spare engines and parts, net of estimated residual value Straight-line 20 years

Buildings Straight-line 40 years

Leasehold improvements Straight-line Term of lease

Assets under capital leases Straight-line Term of lease