Westjet 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 WestJet 2009 Annual Report

shares were acquired through the open market. For 2009, our

matching expense was $47.0 million, a 9.5 per cent increase

from 2008, driven primarily by an increase in salary expense,

as well as a greater number of participating WestJetters in the

ESPP versus a year ago.

Employee profit share

All employees are eligible to participate in the employee profi t

sharing plan. As the profit share system is a variable cost,

employees receive larger awards when we are more profi table.

Conversely, the amount distributed to employees is reduced and

adjusted in less profi table periods. Our profi t share expense for

the year ended December 31, 2009, was $14.7 million, a 56.1

per cent decrease from $33.4 million in 2008. This decline was

directly attributable to lower earnings eligible for profi t share,

due primarily to the decrease in revenues versus the prior year.

As a result of our continued profi tability, we were pleased that

our WestJetters earned a bonus payout of almost four per cent

in 2009. This brings our total profi t share payout since 1996 to

approximately $178 million.

Stock option plan

Pilots, senior executives and certain non-executive employees

participate in the stock option plan. As new options are granted,

the fair value of these options, as determined by the Black-

Scholes option pricing model on the date of grant, is expensed

over the vesting period, with an offsetting entry to contributed

surplus. Stock-based compensation expense related to stock

options for the year ended December 31, 2009, was $12.0

million, representing a decrease of 4.4 per cent over 2008. This

decrease in stock option expense related primarily to the vesting

of options granted under the 2006 pilot agreement, in which a

signifi cant number of stock options were granted. This was offset

Salaries and benefi ts are determined via a framework of job

levels based on internal experience and external market data.

During 2009, salaries and benefi ts increased by 9.3 per cent to

$392.7 million from $359.2 million in 2008. This increase was

due primarily to higher pilot salaries and benefi ts resulting

from the new pilot agreement effective July 1, 2009; a cash

payout relating to an executive’s departure from the Company;

incremental salary costs associated with the challenges posed by

the reservation system implementation, as previously discussed;

and annual market and merit increases. Salaries and benefi ts

expense for each department is included in the respective

department’s operating expense line item.

Employee share purchase plan (ESPP)

Our ESPP encourages employees to become owners of WestJet

shares. Under the terms of the ESPP, WestJetters may acquire

voting shares of WestJet at the current fair market value, and

these acquisitions will be matched by us up to a maximum of

20 per cent of their gross pay. As at December 31, 2009, 84 per

cent of our eligible active employees participated in the ESPP,

contributing an average of 15 per cent. During the year ended

December 31, 2009, we matched contributions for every dollar

contributed by our employees. Under the terms of the ESPP, we

have the option to acquire voting shares on behalf of employees

through open market purchases or to issue shares from treasury

at the current market price, which is determined based on the

volume-weighted average trading price of the common shares

for the fi ve trading days preceding the issuance. For the year

ended December 31, 2009, we elected to issue shares from

treasury for a portion of our matching contribution. A total of

977,459 shares were issued from treasury at a total market value

of $11.1 million for which no cash was exchanged. The remaining

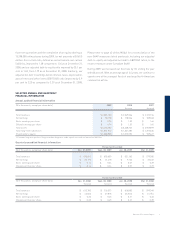

Three months ended December 31 Twelve months ended December 31

($ in thousands) 2009 2008 Change 2009 2008 Change

Salaries and benefi ts $ 100,012 $ 91,353 9.5% $ 392,749 $ 359,231 9.3%

Employee share purchase plan 12,173 11,366 7.1% 47,030 42,937 9.5%

Employee profi t share 2,297 6,648 (65.4%) 14,675 33,435 (56.1%)

Stock option plan 2,264 2,460 (8.0%) 12,045 12,597 (4.4%)

Executive share unit plan (185) 172 (207.6%) 1,395 888 57.1%

$ 116,561 $ 111,999 4.1% $ 467,894 $ 449,088 4.2%