Westjet 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 WestJet 2009 Annual Report

exchange forward contracts and option arrangements. Upon

proper qualifi cation, we designate our foreign exchange forward

contracts as cash fl ow hedges for accounting purposes. For a

discussion of the nature and extent of our use of US-dollar foreign

exchange forward contracts and option arrangements, including

the business purposes they serve; risk management activities;

the fi nancial statement classifi cation and amounts of income,

expense, gains and losses associated with the instruments; and

the signifi cant assumptions made in determining their fair value,

please refer to Results of Operations – Foreign Exchange on page

19 of this MD&A.

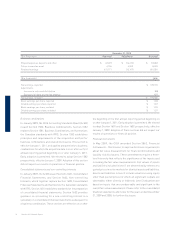

Interest rate risk

Interest rate risk is the risk that the value of fi nancial assets

and liabilities or future cash fl ows will fl uctuate as a result of

changes in market interest rates. We are exposed to interest

rate fl uctuations on short-term investments included in our cash

and cash equivalents balance. We are also exposed to interest

rate fl uctuations on our deposits that relate to purchased aircraft

and airport operations, which, as at December 31, 2009, totalled

$27.3 million (2008 – $24.3 million). The fi xed-rate nature of the

majority of our long-term debt reduces the risk of interest rate

fl uctuations over the term of the outstanding debt. Additionally,

we are exposed to interest rate fl uctuations on our variable-rate

long-term debt, which, as at December 31, 2009, totalled $8.6

million (2008 – $11.2 million) or 0.7 per cent (2008 – 0.8 per cent)

of our total long-term debt.

Credit risk

Credit risk is the risk that one party to a fi nancial instrument will

cause a fi nancial loss for the other party by failing to discharge

an obligation. As at December 31, 2009, our credit exposure

consisted primarily of the carrying amounts of cash and cash

equivalents, accounts receivable, deposits, as well as the fair

value of derivative fi nancial assets. Cash and cash equivalents

consist of bank balances and short-term investments with terms

of up to one year, with the majority less than 91 days. Credit

risk associated with cash and cash equivalents is minimized

substantially by ensuring that these financial assets are

invested primarily in debt instruments with highly rated fi nancial

institutions. Furthermore, we manage our exposure risk by

assessing the fi nancial strength of our counterparties and by

We are exposed to market, credit and liquidity risks associated

with our fi nancial assets and liabilities. We, from time to time,

use various fi nancial derivatives to reduce market risk exposures

from changes in foreign exchange rates, interest rates and jet

fuel prices. We do not hold or use any derivative instruments for

trading or speculative purposes.

Overall, our Board of Directors has responsibility for the

establishment and approval of our risk management policies.

Management continually performs risk assessments to ensure

that all signifi cant risks related to us and our operations have

been reviewed and assessed to reflect changes in market

conditions and our operating activities.

Fuel risk

The airline industry is inherently dependent upon jet fuel to

operate and, therefore, we are exposed to the risk of volatile fuel

prices. Fuel prices are impacted by a host of factors outside our

control, such as signifi cant weather events, geopolitical tensions,

refi nery capacity, and global demand and supply. To provide

management with reasonable foresight and predictability into

operations and future cash fl ows, we periodically use short-term

and long-term fi nancial derivatives. Upon proper qualifi cation,

we designate our fuel derivatives as cash flow hedges for

accounting purposes. For a discussion of the nature and extent

of our use of fuel derivatives for the years ended December 31,

2009 and 2008, including the business purposes they serve; risk

management activities; the fi nancial statement classifi cation

and amounts of income, expense, gains and losses associated

with the instruments; and the signifi cant assumptions made in

determining their fair value, please refer to Results of Operations

– Aircraft Fuel on page 15 of this MD&A.

Foreign exchange risk

Foreign exchange risk is the risk that the fair value of recognized

assets and liabilities or future cash fl ows would fl uctuate as a

result of changes in foreign exchange rates. We are exposed to

foreign exchange risks arising from fl uctuations in exchange

rates on our US-dollar-denominated net monetary assets and

our operating expenditures, mainly aircraft fuel, aircraft leasing

expense, certain maintenance costs and a portion of airport

operations costs. To manage our exposure, we periodically use

fi nancial derivative instruments, including US-dollar foreign