Westjet 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 WestJet 2009 Annual Report

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

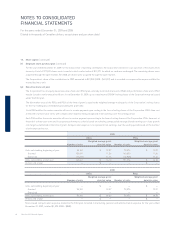

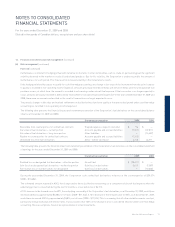

13. Financial instruments and risk management (continued)

(b) Risk management (continued)

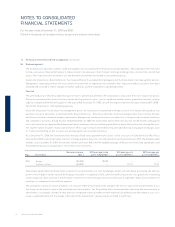

Credit risk (continued)

As at December 31, 2009, the Corporation determined that $2,368 of its accounts receivable balance relating to its cargo operations was doubtful,

as amounts receivable are in dispute with the counterparty. Accordingly, the Corporation has recorded a bad debt provision for the amount.

(iii) Derivative fi nancial instruments

The Corporation recognizes that it is subject to credit risk arising from derivative transactions that are in an asset position at the balance sheet date.

The Corporation carefully monitors this risk by closely considering the size, credit rating and diversifi cation of the counterparty. As at December

31, 2009, fuel derivatives of $96 (2008 - $nil) and foreign exchange derivatives of $181 (2008 - $6,735) outstanding with one of the Corporation’s

counterparties were in an asset position. The Corporation does not expect this counterparty to fail to meet its obligations.

(iv) Deposits

The Corporation is not exposed to counterparty credit risk on its deposits that relate to purchased aircraft, as the funds are held in a security trust

separate from the assets of the fi nancial institution. While the Corporation is exposed to counterparty credit risk on its deposit relating to airport

operations, it considers this risk to be remote because of the nature of the deposit and the credit risk rating of the counterparty.

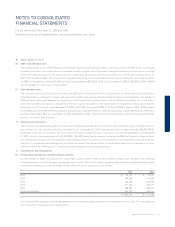

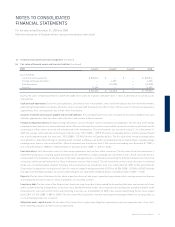

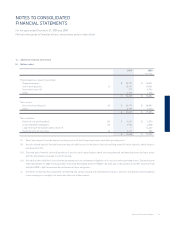

Liquidity risk

Liquidity risk is the risk that the Corporation will encounter diffi culty in meeting obligations associated with fi nancial liabilities. The Corporation

maintains a strong liquidity position and suffi cient fi nancial resources to meet its obligations as they fall due.

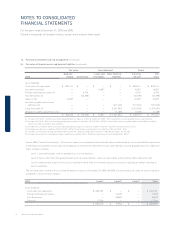

The table below presents a maturity analysis of the Corporation’s undiscounted contractual cash fl ows for its non-derivative and derivative fi nancial

liabilities as at December 31, 2009. The analysis is based on foreign exchange and interest rates in effect at the balance sheet date, and includes

both principal and interest cash fl ows for long-term debt and obligations under capital leases.

A portion of the Corporation’s cash and cash equivalents balance relates to cash collected with respect to advance ticket sales, for which the

balance at December 31, 2009, was $286,361 (2008 – $251,354). Typically, the Corporation has cash and cash equivalents on hand to have suffi cient

liquidity to meet its liabilities when due, under both normal and stressed conditions. As at December 31, 2009, the Corporation had cash and cash

equivalents on hand of 3.51 (2008 – 3.26) times the advance ticket sales balance.

The Corporation aims to maintain a current ratio, defi ned as current assets over current liabilities, of at least 1.00. As at December 31, 2009, the

Corporation’s current ratio was 1.48 (2008 – 1.24).

As at December 31, 2009, the Corporation has not been required to post collateral with respect to any of its outstanding derivative contracts.

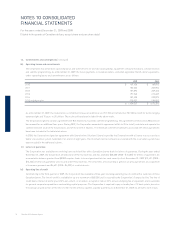

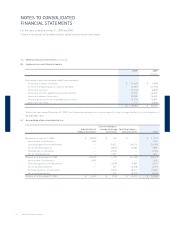

Total Within 1 year 1 – 3 years 4 – 5 years Over 5 years

Accounts payable and accrued liabilities (i) $ (221,208) $ (221,208) $ — $ — $ —

Foreign exchange derivatives (1,430) (1,430) — — —

Fuel derivatives (8,763) (8,763) — — —

Long-term debt (1,466,636) (232,461) (447,906) (397,540) (388,729)

Obligations under capital leases (6,822) (943) (527) (490) (4,862)

Total $ (1,704,859) $ (464,805) $ (448,433) $ (398,030) $ (393,591)

(i) Excludes fuel-derivative liabilities of $8,763 and foreign exchange derivative liabilities of $1,430.