Westjet 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 WestJet 2009 Annual Report

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

For the years ended December 31, 2009 and 2008

(Stated in thousands of Canadian dollars, except share and per share data)

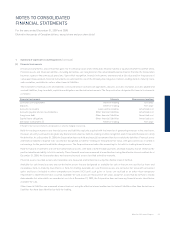

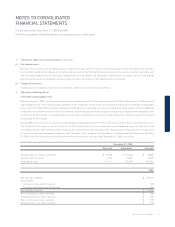

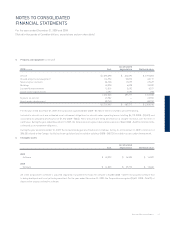

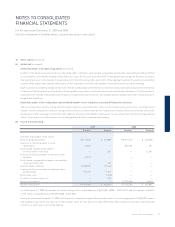

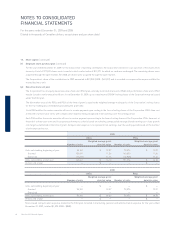

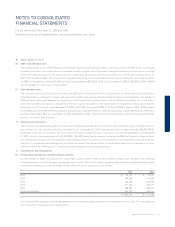

7. Long-term debt

(i) 52 individual term loans, amortized on a straight-line basis over a 12-year term, each repayable in quarterly principal instalments ranging from

$668 to $955, including fi xed interest at a weighted average rate of 5.32%, maturing between 2014 and 2020. These facilities are guaranteed

by Ex-Im Bank and secured by one 800-series aircraft, 38 700-series aircraft and 13 600-series aircraft.

(ii) Term loan of US $32,000 repayable in quarterly instalments of US $1,788, including fi xed interest at a rate of 4.315%, maturing in 2014. This

facility is secured by one 800-series aircraft.

(iii) Term loan repayable in monthly instalments of $91, including fl oating interest at the bank’s prime rate plus 0.88%, with an effective interest

rate of 3.13% as at December 31, 2009, maturing in 2011, secured by one fl ight simulator.

(iv) Three individual term loans, amortized on a straight-line basis over a fi ve-year term, repayable in quarterly principal instalments of $41,

including fl oating interest at the Canadian LIBOR rate plus 0.08%, with a weighted average effective interest rate of 1.80% as at December

31, 2009, maturing in 2010 and 2011. These facilities are for the purchase of live satellite television equipment, are guaranteed by the Ex-Im

Bank and are secured by certain 700-series and 600-series aircraft.

(v) Term loan repayable in monthly instalments of $108, including fi xed interest at 9.03%, maturing April 2011, secured by the Calgary

Hangar facility.

(vi) Term loan repayable in monthly instalments of $50, including fl oating interest at the bank’s prime rate plus 0.50%, with an effective interest

rate of 2.75% as at December 31, 2009, maturing April 2013, secured by the Calgary Hangar facility.

The net book value of the property and equipment pledged as collateral for the Corporation’s secured borrowings was $1,925,672 as at December

31, 2009 (2008 – $2,012,915).

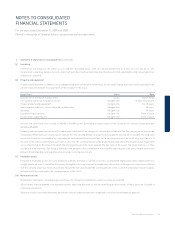

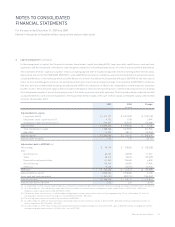

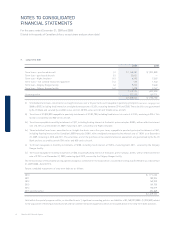

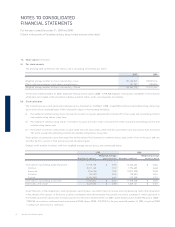

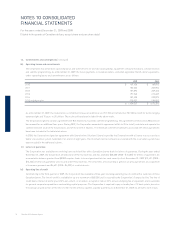

Future scheduled repayments of long-term debt are as follows:

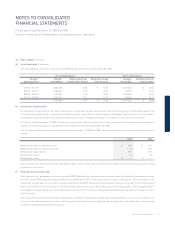

Held within the special-purpose entities, as identifi ed in note 1, signifi cant accounting policies, are liabilities of $1,168,907 (2008 – $1,332,859) related

to the acquisition of the 52 purchased aircraft and live satellite television equipment, which are included above in the long-term debt balances.

2009 2008

Term loans – purchased aircraft (i) $ 1,168,381 $ 1,331,083

Term loan – purchased aircraft (ii) 33,631 —

Term loan – fl ight simulator (iii) 6,392 7,265

Term loans – live satellite television equipment (iv) 493 1,740

Term loan – Calgary Hangar facility (v) 9,202 9,648

Term loan – Calgary Hangar facility (vi) 1,678 2,167

1,219,777 1,351,903

Current portion 171,223 165,721

$ 1,048,554 $ 1,186,182

2010 $ 171,223

2011 183,924

2012 169,992

2013 169,750

2014 170,019

2015 and thereafter 354,869

$ 1,219,777