WeightWatchers 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

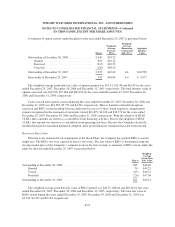

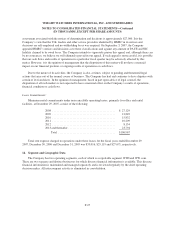

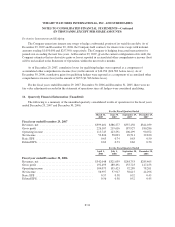

Derivative Instruments and Hedging:

The Company enters into interest rate swaps to hedge a substantial portion of its variable rate debt. As of

December 29, 2007 and December 30, 2006, the Company held contracts for interest rate swaps with notional

amounts totaling $1,050,000 and $257,500, respectively. The Company is hedging forecasted transactions for

periods not exceeding the next five years. At December 29, 2007, given the current configuration of its debt, the

Company estimates that no derivative gains or losses reported in accumulated other comprehensive income (loss)

will be reclassified to the Statement of Operations within the next twelve months.

As of December 29, 2007, cumulative losses for qualifying hedges were reported as a component of

accumulated other comprehensive income (loss) in the amount of $14,994 ($24,582 before taxes). As of

December 30, 2006, cumulative gains for qualifying hedges were reported as a component of accumulated other

comprehensive income (loss) in the amount of $955 ($1,566 before taxes).

For the fiscal years ended December 29, 2007, December 30, 2006 and December 31, 2005, there were no

fair value adjustments recorded in the statement of operations since all hedges were considered qualifying.

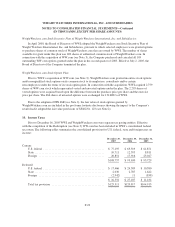

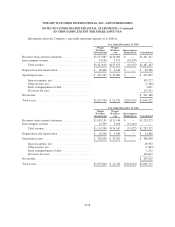

16. Quarterly Financial Information (Unaudited)

The following is a summary of the unaudited quarterly consolidated results of operations for the fiscal years

ended December 29, 2007 and December 30, 2006.

For the Fiscal Quarters Ended

March 31,

2007

June 30,

2007

September 29,

2007

December 29,

2007

Fiscal year ended December 29, 2007

Revenues, net ..................................... $399,401 $386,277 $337,450 $344,039

Gross profit ....................................... 226,107 219,616 187,927 180,286

Operating income .................................. 115,745 123,291 106,499 90,072

Net income ....................................... 53,826 58,023 49,511 39,820

Basic EPS ........................................ 0.63 0.74 0.63 0.50

Diluted EPS ....................................... 0.63 0.73 0.62 0.50

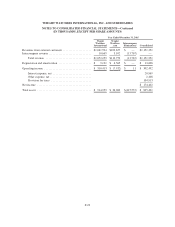

For the Fiscal Quarters Ended

April 1,

2006

July 1,

2006

September 30,

2006

December 30,

2006

Fiscal year ended December 30, 2006

Revenues, net ..................................... $342,048 $321,059 $284,753 $285,465

Gross profit ....................................... 192,493 180,491 155,723 147,453

Operating income .................................. 104,075 105,423 92,289 78,261

Net income ....................................... 56,997 57,917 50,615 44,296

Basic EPS ........................................ 0.57 0.58 0.52 0.45

Diluted EPS ....................................... 0.56 0.58 0.52 0.45

F-31