WeightWatchers 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

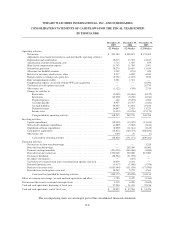

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

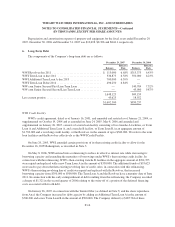

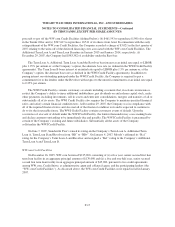

Depreciation and amortization expense of property and equipment for the fiscal years ended December 29,

2007, December 30, 2006 and December 31, 2005 was $10,698, $8,326 and $8,611, respectively.

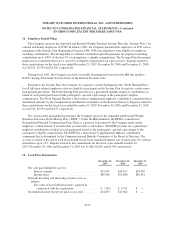

6. Long-Term Debt

The components of the Company’s long-term debt are as follows:

December 29, 2007 December 30, 2006

Balance

Effective

Rate Balance

Effective

Rate

WWI Revolver due 2011 .................................. $ 115,000 6.68% $313,375 6.43%

WWI Term Loan A due 2011 .............................. 336,875 6.58% 350,000 6.23%

WWI Additional Term Loan A due 2013 ..................... 700,000 6.59% —

WWI Term Loan B due 2014 ............................... 496,250 6.84% —

WW.com Senior Secured First Lien Term Loan ................ — 140,784 7.32%

WW.com Senior Secured Second Lien Term Loan .............. — 45,000 9.87%

1,648,125 849,159

Less current portion ...................................... 45,625 18,922

$1,602,500 $830,237

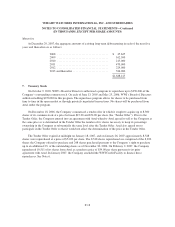

WWI Credit Facility

WWI’s credit agreement, dated as of January 16, 2001, and amended and restated as of January 21, 2004, as

supplemented on October 19, 2004 and as amended on June 24, 2005, May 8, 2006 and amended and

supplemented on January 26, 2007, consists of a term loan facility consisting of two tranche A facilities, or Term

Loan A and Additional Term Loan A, and a tranche B facility, or Term Loan B, in an aggregate amount of

$1,550,000 and a revolving credit facility, or the Revolver, in the amount of up to $500,000. We refer to the term

loan facilities and the Revolver collectively as the WWI Credit Facility.

On June 24, 2005, WWI amended certain provisions of its then-existing credit facility to allow for the

December 16, 2005 Redemption, as described in Note 3.

On May 8, 2006, WWI entered into a refinancing to reduce its effective interest rate while increasing its

borrowing capacity and extending the maturities of borrowings under WWI’s then-existing credit facility. In

connection with the refinancing, WWI’s then-existing tranche B facilities in the aggregate amount of $294,375

were repaid and replaced with a new Term Loan A in the amount of $350,000. The additional funds of $55,625

were used to pay down the then-existing revolving line of credit. Also, in connection with this refinancing,

WWI’s then-existing revolving line of credit was repaid and replaced with the Revolver, that increased

borrowing capacity from $350,000 to $500,000. The Term Loan A and the Revolver have a maturity date of June

2011. In connection with the early extinguishment of debt resulting from this refinancing, the Company recorded

a charge of $1,321 in the second quarter of 2006 relating to the write-off of a portion of the deferred financing

costs associated with its old debt.

On January 26, 2007, in connection with the Tender Offer (as defined in Note 7) and the share repurchase

from Artal, the Company increased its debt capacity by adding an Additional Term Loan A in the amount of

$700,000 and a new Term Loan B in the amount of $500,000. The Company utilized (a) $185,784 of these

F-16