WeightWatchers 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

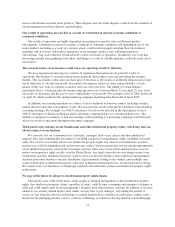

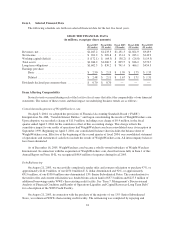

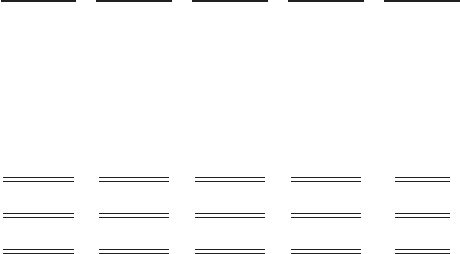

Item 6. Selected Financial Data

The following schedule sets forth our selected financial data for the last five fiscal years.

SELECTED FINANCIAL DATA

(in millions, except per share amounts)

Fiscal 2007

(52 weeks)

Fiscal 2006

(52 weeks)

Fiscal 2005

(52 weeks)

Fiscal 2004

(52 weeks)

Fiscal 2003

(53 weeks)

Revenues, net ................................ $1,467.2 $1,233.3 $1,151.3 $1,024.9 $943.9

Net income ................................. $ 201.2 $ 209.8 $ 174.4 $ 183.1 $143.9

Working capital (deficit) ....................... $ (172.1) $ (64.3) $ (38.2) $ (26.8) $ (19.5)

Total assets ................................. $1,046.2 $1,000.7 $ 835.5 $ 816.2 $770.7

Long-term obligations ......................... $1,602.5 $ 830.2 $ 741.4 $ 466.1 $454.3

Earnings per share:

Basic .................................. $ 2.50 $ 2.13 $ 1.70 $ 1.75 $ 1.35

Diluted ................................. $ 2.48 $ 2.11 $ 1.67 $ 1.71 $ 1.31

Dividends declared per common share ............ $ 0.70 $ 0.70 — — —

Items Affecting Comparability

Several events occurred during each of the last five fiscal years that affect the comparability of our financial

statements. The nature of these events and their impact on underlying business trends are as follows:

Consolidation/Acquisition of WeightWatchers.com

On April 3, 2004, we adopted the provisions of Financial Accounting Standards Board (“FASB”)

Interpretation No. 46R, “Variable Interest Entities,” and began consolidating the results of WeightWatchers.com.

Upon adoption, we recorded a charge of $11.9 million, including a tax charge of $9.9 million, in the fiscal

quarter ended April 3, 2004 for the cumulative effect of this accounting change. This charge reflects the

cumulative impact to our results of operations had WeightWatchers.com been consolidated since its inception in

September 1999. Beginning on April 3, 2004, our consolidated balance sheet includes the balance sheet of

WeightWatchers.com. Effective at the beginning of the second quarter of fiscal 2004, our consolidated statement

of operations and statement of cash flows include the results of WeightWatchers.com. All intercompany balances

have been eliminated.

As of December 16, 2005, WeightWatchers.com became a wholly-owned subsidiary of Weight Watchers

International. In connection with the acquisition of WeightWatchers.com, described more fully in Item 1 of this

Annual Report on Form 10-K, we recognized $46.4 million of expenses during fiscal 2005.

Debt Refinancing

On August 21, 2003, we successfully completed a tender offer and consent solicitation to purchase 97%, or

approximately $144.9 million, of our $150.0 million U.S. dollar denominated and 92%, or approximately

€91.6 million, of our €100.0 million euro denominated 13% Senior Subordinated Notes. The consideration for

the tender offer and consent solicitation was funded from cash on hand of $57.3 million and $227.3 million of

additional borrowings under WWI’s then-existing credit facility. See “Item 7. Management’s Discussion and

Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources-Long Term Debt”

for a description of the WWI Credit Facility.

On August 21, 2003, in connection with the purchase of the majority of our 13% Senior Subordinated

Notes, we refinanced WWI’s then-existing credit facility. The refinancing was completed by repaying and

24