WeightWatchers 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

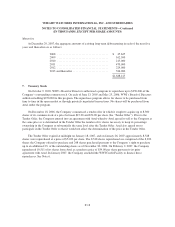

proceeds to pay off the WW.com Credit Facilities (defined below), (b) $461,593 to repurchase 8,548 of its shares

in the Tender Offer and (c) $567,617 to repurchase 10,511 of its shares from Artal. In connection with the early

extinguishment of the WW.com Credit Facilities, the Company recorded a charge of $3,021 in the first quarter of

2007 relating to the write-off of the deferred financing costs associated with the WW.com Credit Facilities. The

Additional Term Loan A and Term Loan B mature in January 2013 and January 2014, respectively. At

December 29, 2007, the Company had $383,382 of availability under the Revolver.

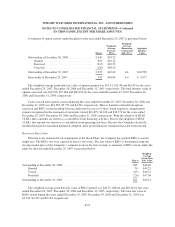

The Term Loan A, Additional Term Loan A and the Revolver bear interest at an initial rate equal to LIBOR

plus 1.25% per annum or, at the Company’s option, the alternate base rate (as defined in the WWI Credit Facility

agreements). The Term Loan B bears interest at an initial rate equal to LIBOR plus 1.5% per annum or, at the

Company’s option, the alternate base rate (as defined in the WWI Credit Facility agreements). In addition to

paying interest on outstanding principal under the WWI Credit Facility, the Company is required to pay a

commitment fee to the lenders under the Revolver with respect to the unused commitments at an initial rate equal

to 0.25% per annum.

The WWI Credit Facility contains customary covenants including covenants that, in certain circumstances,

restrict the Company’s ability to incur additional indebtedness, pay dividends on and redeem capital stock, make

other payments, including investments, sell its assets and enter into consolidations, mergers and transfers of all or

substantially all of its assets. The WWI Credit Facility also requires the Company to maintain specified financial

ratios and satisfy certain financial condition tests. At December 29, 2007, the Company was in compliance with

all of the required financial ratios and also met all of the financial condition tests and is expected to continue to

do so for the foreseeable future. The WWI Credit Facility contains customary events of default. Upon the

occurrence of an event of default under the WWI Credit Facility, the lenders thereunder may cease making loans

and declare amounts outstanding to be immediately due and payable. The WWI Credit Facility is guaranteed by

certain of the Company’s existing and future subsidiaries. Substantially all the assets of the Company

collateralize the WWI Credit Facility.

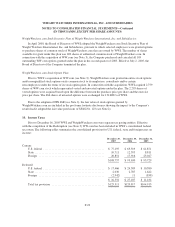

On June 7, 2007, Standard & Poor’s raised its rating on the Company’s Term Loan A, Additional Term

Loan A, Term Loan B and Revolver from “BB” to “BB+”. On January 4, 2007, Moody’s affirmed its “Ba1”

rating for the Company’s Term Loan A and Revolver and assigned a “Ba1” rating to the Company’s Additional

Term Loan A and Term Loan B.

WW.com Credit Facilities

On December 16, 2005, WW.com borrowed $215,000, consisting of (i) a five year, senior secured first lien

term loan facility in an aggregate principal amount of $170,000 and (ii) a five and one-half year, senior secured

second lien term loan facility in an aggregate principal amount of $45,000, pursuant to two credit agreements

among WW.com, Credit Suisse, as administrative agent and collateral agent, and the participating lenders (the

“WW.com Credit Facilities”). As discussed above, the WW.com Credit Facilities were repaid in full in January

2007.

F-17