WeightWatchers 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

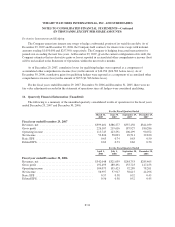

13. Commitments and Contingencies

Legal:

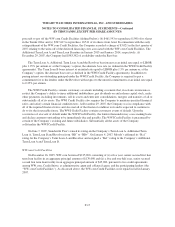

On February 18, 2005, WWI settled two lawsuits with CoolBrands International, Inc. (“CoolBrands”) one

filed by WWI to enforce the termination provisions of the CoolBrands ice cream and frozen novelty license and

the other filed by CoolBrands against WWI and Wells Dairy, Inc. alleging breach of the CoolBrands license.

CoolBrands will no longer manufacture, sell, market or distribute ice cream and frozen novelty products using

WWI’s trademarks.

In March 2006, the Company agreed to settle a litigation filed on behalf of a purported class of employees

under the California Labor Code and the Federal Fair Labor Standards Act for $2,300 plus other costs and

expenses. The settlement was accrued for in fiscal 2005 and the funds were distributed in June 2007 following

final approval by the court.

On July 7, 2006, the Company filed an amended notice of appeal with the U.K. VAT and Duties Tribunal,

or VAT Tribunal, appealing a ruling by Her Majesty’s Revenue and Customs, or HMRC, that from April 1, 2005

Weight Watchers meetings fees in the U.K. should be fully subject to 17.5% standard rated value added tax, or

VAT. For over a decade prior to April 1, 2005, HMRC had determined that Weight Watchers meetings fees in

the U.K. were only partially subject to 17.5% VAT. It is our view that this prior determination by HMRC should

remain in effect and this view was further supported on March 8, 2007 when the VAT Tribunal ruled that Weight

Watchers meetings in the U.K. should only be partially subject to 17.5% VAT. On May 3, 2007, HMRC

appealed to the High Court of Justice Chancery Division, or the High Court, against the VAT Tribunal’s ruling in

our favor, and the appeal at the High Court was heard in November 2007.

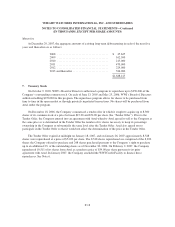

On January 21, 2008, the High Court ruled by denying HMRC’s appeal in part by upholding the VAT

Tribunal’s decision to the extent that, at the first meeting which members attend, meetings fees associated with

such meeting are partially subject to 17.5% VAT. However, the High Court allowed HMRC’s appeal in relation

to meetings subsequent to the first meeting and concluded that meetings fees associated with subsequent

meetings are fully subject to 17.5% VAT. The Company intends to vigorously defend the VAT Tribunal’s ruling

and to file an appeal in part against the High Court’s ruling in relation to meetings subsequent to the first

meeting. The Company expects HMRC to file an appeal in part against the High Court’s ruling in relation to the

first meeting which members attend. If Weight Watchers meetings fees in the U.K. are deemed to be fully subject

to 17.5% VAT, we estimate the amount owed to HMRC would be approximately $50,000 as of the end of fiscal

2007, covering fiscal years 2005 through 2007, against which we have recorded a reserve of $23,400 as of the

end of fiscal 2007, which represents management’s most appropriate estimate of loss. If the Company is

ultimately unsuccessful in establishing that Weight Watchers meetings fees in the U.K. are partially subject to

17.5% VAT, or if it is determined that a greater proportion of Weight Watchers meetings fees as compared to

HMRC’s prior rulings is subject to 17.5% VAT, we may incur monetary liability in excess of reserves previously

recorded and our U.K. results of operations may be adversely affected in the future. It is also possible that our

cash flows and results of operations in a particular fiscal quarter may be adversely affected by this matter.

However, it is the opinion of management that the ultimate disposition of this matter, to the extent not previously

provided for, will not have a material impact on our financial position, or ongoing results of operations or cash

flows.

On July 27, 2007, HMRC issued to us notices of determination and decisions that, for the period April 2001

to April 2007, our leaders and certain other service providers should have been classified as employees for tax

purposes and, as such, we should have withheld tax from the leaders and certain other service providers pursuant

to the PAYE and NIC collection rules and remitted such amounts to the HMRC. As of the end of fiscal 2007, the

F-26