WeightWatchers 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

connection with the acquisition of WW.com (See Note 3), no compensation expense for employee stock options

was reflected in earnings, as all options were granted with an exercise price equal to the fair market price as

determined in accordance with our Stock Plans.

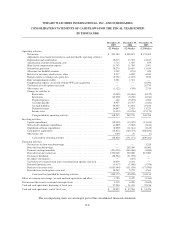

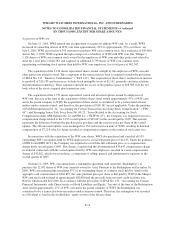

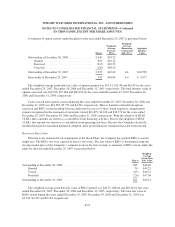

The following table illustrates the effect on net income and earnings per share if the Company had applied

the fair value recognition provisions of SFAS No. 123 in fiscal 2005:

December 31,

2005

Net income, as reported ............................................................ $174,402

Add:

Total share-based employee compensation expense as recorded under FIN 44 and APB 25, net

of related tax effect .......................................................... 27,680

Deduct:

Total share-based employee compensation expense determined under the fair value method

for all share-based awards, net of related tax effect ................................. (31,663)

Pro forma net income .............................................................. $170,419

Earnings per share:

Basic—as reported ............................................................ $ 1.70

Basic—pro forma ............................................................. $ 1.66

Diluted—as reported ........................................................... $ 1.67

Diluted—pro forma ........................................................... $ 1.64

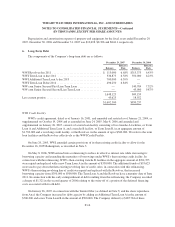

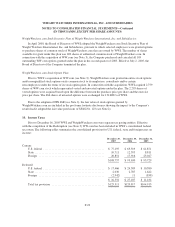

The Company adopted the provisions of SFAS 123(R), “Share-Based Payment” on January 1, 2006. Upon

adopting this standard, the Company began recognizing the cost of all share-based awards based on their

estimated grant-date fair value over the related service period of such awards. For the years ended December 29,

2007 and December 30, 2006, the impact of adopting SFAS 123(R) was to reduce income before income taxes by

$6,195 and $6,313, respectively, and net income by $3,779 and $3,851, respectively, with a corresponding

reduction in basic and diluted earnings per share of $0.05 and $0.04, respectively. In accordance with SFAS

123(R), the Company has elected to apply the modified prospective transition method to all past awards

outstanding and unvested as of the date of adoption and has begun to recognize the associated expense over the

remaining vesting period based on the fair values previously determined and disclosed as part of its pro forma

disclosures. The Company has not restated the results of prior periods.

On November 10, 2005, the FASB issued Staff Position No. FAS 123(R)-3, “Transition Election Related to

Accounting for the Tax Effects of Share-Based Payment Awards” (the “FSP”). The FSP allows companies to

elect a specified “short-cut” method to calculate the historical pool of windfall tax benefits upon adoption of

SFAS 123(R). The Company elected to use this “short-cut” method when it adopted SFAS 123(R) on January 1,

2006.

In accordance with the modified prospective transition method of adopting SFAS 123(R), the Company

elected to include the impact of pro forma deferred tax assets (i.e., the “as if” windfall or shortfall) for purposes

of determining assumed proceeds under the treasury stock method when determining the denominator for diluted

earnings per share.

F-12