WeightWatchers 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

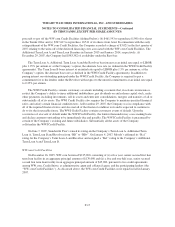

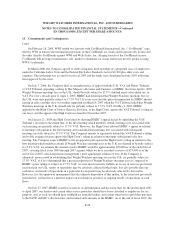

In fiscal 2005, due to the then recent trend in profitability of certain WeightWatchers.com’s foreign

operations, it was concluded that it was more likely than not that these foreign operations would fully realize the

benefit of its deferred tax assets. As such, WeightWatchers.com reversed all of its remaining $1,593 valuation

allowance associated with its foreign net operating loss carryforwards, except for a full valuation allowance of

$575 relating to certain foreign operations. This amount was subsequently reversed in fiscal 2006 due to the

utilization of the net operating loss carryforwards.

The Company’s undistributed earnings of foreign subsidiaries are not considered to be reinvested

permanently. Accordingly, the Company has recorded all taxes, after taking into account foreign tax credits, on

the undistributed earnings of foreign subsidiaries.

During the fourth quarter of fiscal 2006, the Company recorded a tax benefit of approximately $6,300 by

reversing tax reserves which due to the resolution of certain tax matters were no longer necessary partially offset

by adjustments to its tax valuation allowance for foreign tax net operating loss carryforwards.

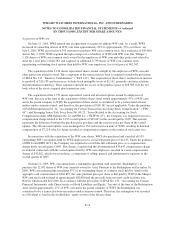

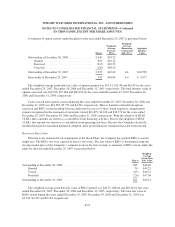

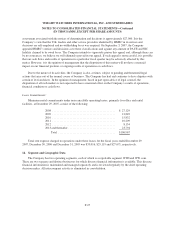

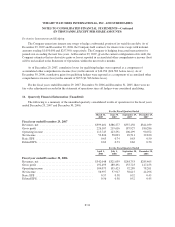

The Company adopted the provisions of FIN 48 on December 31, 2006, the first day of its 2007 fiscal year.

As a result of the adoption of this standard, the Company recognized a $1,907 increase in the liability for

unrecognized tax benefits, which was accounted for as a reduction to the opening balance of retained earnings for

fiscal 2007. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Balance at December 31, 2006 .................................................. $8,232

Additions based on tax positions related to the current year ........................... 2,319

Additions based on tax positions of prior years ..................................... 248

Reductions for tax positions of prior years ........................................ (801)

Settlements ................................................................. (543)

Balance at December 29, 2007 .................................................. $9,455

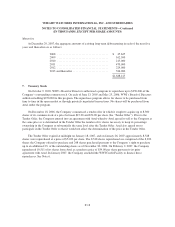

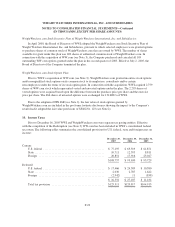

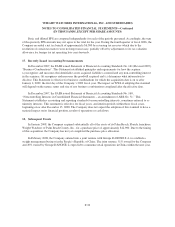

At December 29, 2007, the total amount of unrecognized tax benefits that, if recognized, would affect our

effective tax rate is $4,182. As of December 29, 2007, given the nature of the Company’s uncertain tax positions,

it is reasonably possible that there will not be a significant change in the Company’s uncertain tax benefits within

the next twelve months.

The Company recognizes interest and penalties related to unrecognized tax benefits in income tax expense.

The Company had $1,224 and $708 of accrued interest and penalties at December 29, 2007 and December 30,

2006, respectively. The Company recognized $516 in interest and penalties during the fiscal year ended

December 29, 2007.

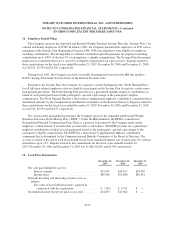

The Company or one of its subsidiaries files income tax returns in the U.S. federal jurisdiction, and various

state and foreign jurisdictions. At December 29, 2007, with few exceptions, the Company was no longer subject

to U.S. federal, state or local income tax examinations by tax authorities for years prior to 2004, or non-U.S.

income tax examinations by tax authorities for years prior to 2001. The Internal Revenue Service (“IRS”)

completed an examination of the Company’s U.S. federal income tax returns for the years 2002 through 2003.

The IRS proposed and management agreed to certain adjustments that did not have a material impact on the

Company’s financial position, results of operations or cash flows.

F-24