WeightWatchers 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

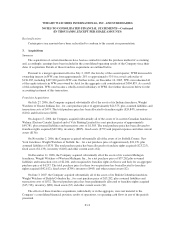

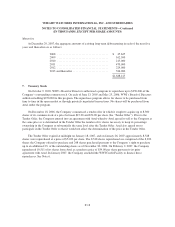

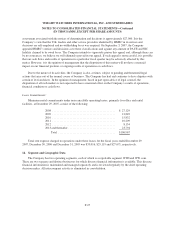

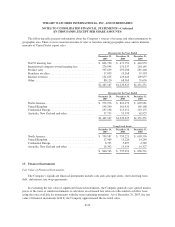

The components of the Company’s consolidated income before income taxes consist of the following:

December 29,

2007

December 30,

2006

December 31,

2005

Domestic ...................................... $254,678 $260,130 $212,085

Foreign ....................................... 71,813 70,512 67,230

$326,491 $330,642 $279,315

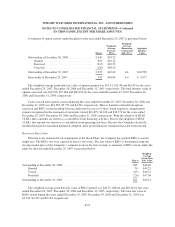

The difference between the U.S. federal statutory tax rate and the Company’s consolidated effective tax rate

are as follows:

December 29,

2007

December 30,

2006

December 31,

2005

U.S. federal statutory rate ......................... 35.0% 35.0% 35.0%

Federal and state tax reserve provision (reversal) ....... 0.3 (3.0) (0.2)

States income taxes (net of federal benefit) ........... 2.9 3.4 2.8

Increase (reduction) in valuation allowance ........... 1.0 1.2 (0.3)

Other ......................................... (0.8) (0.1) 0.3

Effective tax rate ............................ 38.4% 36.5% 37.6%

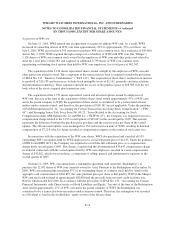

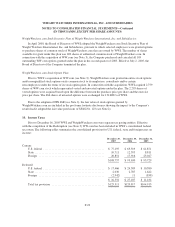

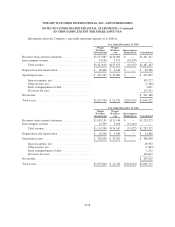

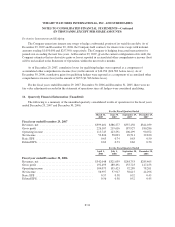

The deferred tax assets (liabilities) recorded on the Company’s consolidated balance sheet are as follows:

December 29,

2007

December 30,

2006

Amortization ............................................... $ 6,111 $31,627

Provision for estimated expenses ................................ 9,554 5,789

Operating loss carryforwards ................................... 13,170 7,517

Salaries and wages ........................................... 5,409 —

Share-based compensation ..................................... 5,033 5,208

Other ..................................................... 5,222 5,621

Less: valuation allowance ..................................... (10,917) (7,517)

Total deferred tax assets ....................................... $33,582 $48,245

Depreciation/amortization ..................................... $ (4,447) $ (3,997)

Prepaid expenses ............................................ (694) (1,213)

Deferred income ............................................. (206) (362)

Other ..................................................... — (4,362)

Total deferred tax liabilities .................................... $ (5,347) $ (9,934)

Net deferred tax assets ........................................ $28,235 $38,311

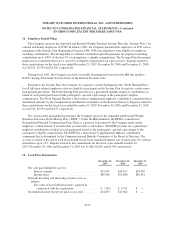

Certain foreign operations of WWI have generated net operating loss carryforwards. If it has been

determined that it is more likely than not that the deferred tax assets associated with these net operating loss

carryforwards will not be utilized a valuation allowance has been recorded. As of December 29, 2007 and

December 30, 2006, various foreign subsidiaries had net operating loss carryforwards of approximately $50,831

and $30,547, respectively, most of which can be carried forward indefinitely.

F-23