WeightWatchers 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

financing activities. Investing activities utilized $400.3 million of cash, including $380.8 million for the

acquisition of the remaining interests in WeightWatchers.com and $19.4 million for capital spending. Net cash

provided for financing activities totaled $103.2 million, comprised of net borrowings of $277.0 million and the

use of $176.0 million for the repurchase of 3.7 million shares of our common stock pursuant to our stock

repurchase plan.

Long-Term Debt

As of December 29, 2007, our credit facility consisted of Term Loan A, Additional Term Loan A, Term

Loan B, and a revolving credit facility, or the Revolver, collectively, the WWI Credit Facility.At December 29,

2007, we had debt of $1,648.1 million and had additional availability under our $500.0 million Revolver of

$383.4 million.

On June 24, 2005, Weight Watchers International amended certain provisions of WWI’s then-existing credit

facility to allow for the December 16, 2005 redemption by WeightWatchers.com of its shares owned by Artal.

On December 16, 2005, WeightWatchers.com borrowed $215.0 million pursuant to two credit facilities,

consisting of (i) a five year, senior secured first lien term loan in an aggregate principal amount of $170.0 million

and (ii) a five and one-half year, senior secured second lien term loan facility in an aggregate principal amount of

$45.0 million.

In May 2006, we entered into a refinancing to reduce our effective interest rate while increasing our

borrowing capacity and extending the maturities of borrowings under WWI’s then-existing credit facility. In

connection with the refinancing, we increased our term loans from $293.4 million to $350.0 million. The

additional funds of $55.6 million were used to pay down the revolving line of credit. Also, in connection with

this refinancing, WWI’s then-existing line of credit was repaid and replaced with a new revolving line of credit

which increased borrowing capacity from $350.0 million to $500.0 million. In connection with this refinancing,

we incurred expenses of $1.3 million.

In January 2007, in connection with the Tender Offer (as discussed in Item 5 herein), we increased our debt

capacity by adding an Additional Term Loan A in the amount of $700 million and a new Term Loan B in the

amount of $500 million. We utilized $185.8 million of these proceeds to pay off the WW.com Credit Facilities.

In connection with this refinancing, we incurred expenses of $3.0 million. The Additional Term Loan A and the

Term Loan B mature in January 2013 and January 2014, respectively.

At December 29, 2007, December 30, 2006 and December 31, 2005, our debt consisted entirely of variable-

rate instruments. The average interest rate on our debt was approximately 6.5%, 6.8% and 6.1%, per annum at

December 29, 2007, December 30, 2006 and December 31, 2005, respectively.

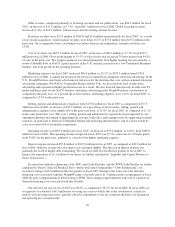

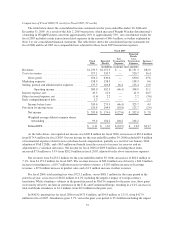

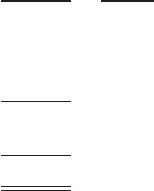

The following schedule sets forth our long-term debt obligations (and interest rates) at December 29, 2007:

Long-Term Debt

At December 29, 2007

(Balances in millions)

Balance

Interest

Rate

Revolver due 2011 ................................................. $ 115.0 6.34%

Term Loan A due 2011 .............................................. 336.9 6.39%

Additional Term Loan A due 2013 ..................................... 700.0 6.50%

Term Loan B due 2014 .............................................. 496.2 6.75%

Total Debt ................................................ 1,648.1

Less Current Portion ............................................ 45.6

Total Long-Term Debt ...................................... $1,602.5

41