WeightWatchers 2007 Annual Report Download - page 75

Download and view the complete annual report

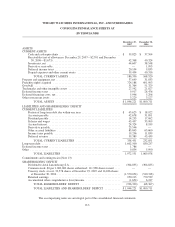

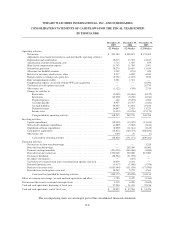

Please find page 75 of the 2007 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

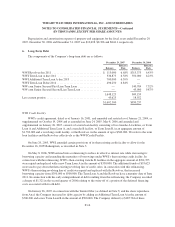

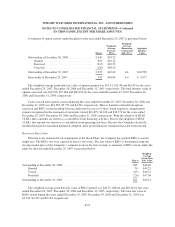

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—Continued

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

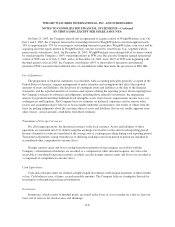

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

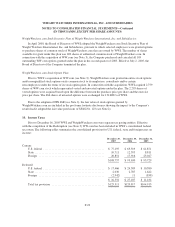

3. Acquisitions

Summary

The acquisitions of certain franchisees have been accounted for under the purchase method of accounting

and, accordingly, earnings have been included in the consolidated operating results of the Company since their

dates of acquisition. Details of these franchise acquisitions are outlined below.

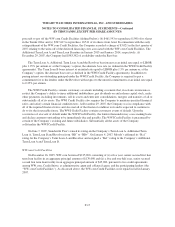

Pursuant to a merger agreement effective July 2, 2005, the last day of the second quarter, WWI increased its

ownership interest in WW.com from approximately 20% to approximately 53% for a total cash outlay of

$136,385, including $107,900 paid to WW.com. Further to this, on December 16, 2005, WW.com redeemed all

of the equity interests in WW.com owned by Artal for the aggregate cash consideration of $304,835. As a result

of this redemption, WW.com became a wholly-owned subsidiary of WWI. See further discussion below for the

accounting treatment of this transaction.

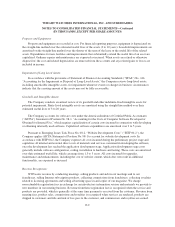

Franchise Acquisitions

On July 27, 2006, the Company acquired substantially all of the assets of its Indiana franchisee, Weight

Watchers of Greater Indiana, Inc., for a net purchase price of approximately $24,575, plus assumed liabilities and

transaction costs of $474. The total purchase price has been allocated to franchise rights ($24,847), inventory

($102) and fixed assets ($100).

On August 17, 2006, the Company acquired substantially all of the assets of its eastern Canadian franchisee,

Walmar (Eastern Canada) Limited and of Vale Printing Limited for a net purchase price of approximately

$49,781, plus assumed liabilities and transaction costs of $1,385. The total purchase price has been allocated to

franchise rights acquired ($49,366), inventory ($885), fixed assets ($779) and prepaid expenses and other current

assets ($136).

On November 2, 2006, the Company acquired substantially all of the assets of its Suffolk County, New

York franchisee, Weight Watchers of Suffolk, Inc., for a net purchase price of approximately $24,170, plus

assumed liabilities of $330. The total purchase price has been allocated to franchise rights acquired ($23,225),

fixed assets ($1,133), inventory ($140) and other current assets ($2).

On December 11, 2006, the Company acquired substantially all of the assets of its western Michigan

franchisee, Weight Watchers of Western Michigan, Inc., for a net purchase price of $37,262 plus assumed

liabilities and transaction costs of $2,284, and reacquired its franchise rights in Greece and Italy for an aggregate

purchase price of $4,297. The total purchase price for these two acquisitions has been allocated to franchise

rights acquired ($42,612), fixed assets ($784), inventory ($445) and other current assets ($2).

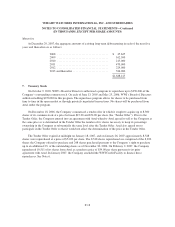

On June 3, 2007, the Company acquired substantially all of the assets of its British Columbia franchisee,

Weight Watchers of British Columbia Inc., for a net purchase price of $15,282, plus assumed liabilities and

transaction costs of $532. The total purchase price has been preliminarily allocated to franchise rights acquired

($15,718), inventory ($88), fixed assets ($7) and other current assets ($1).

The effects of these franchise acquisitions, individually or in the aggregate, were not material to the

Company’s consolidated financial position, results of operations, or operating cash flows in any of the periods

presented.

F-13