United Healthcare 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

In 2009, the Company released tax reserves related to the favorable resolution of various historical state income

tax matters. Along with a change to an insurance premium tax in lieu of an income tax in one of the states in

which the Company operates, this decreased the Company’s effective income tax rate in 2009.

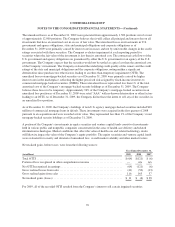

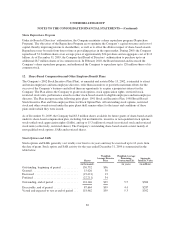

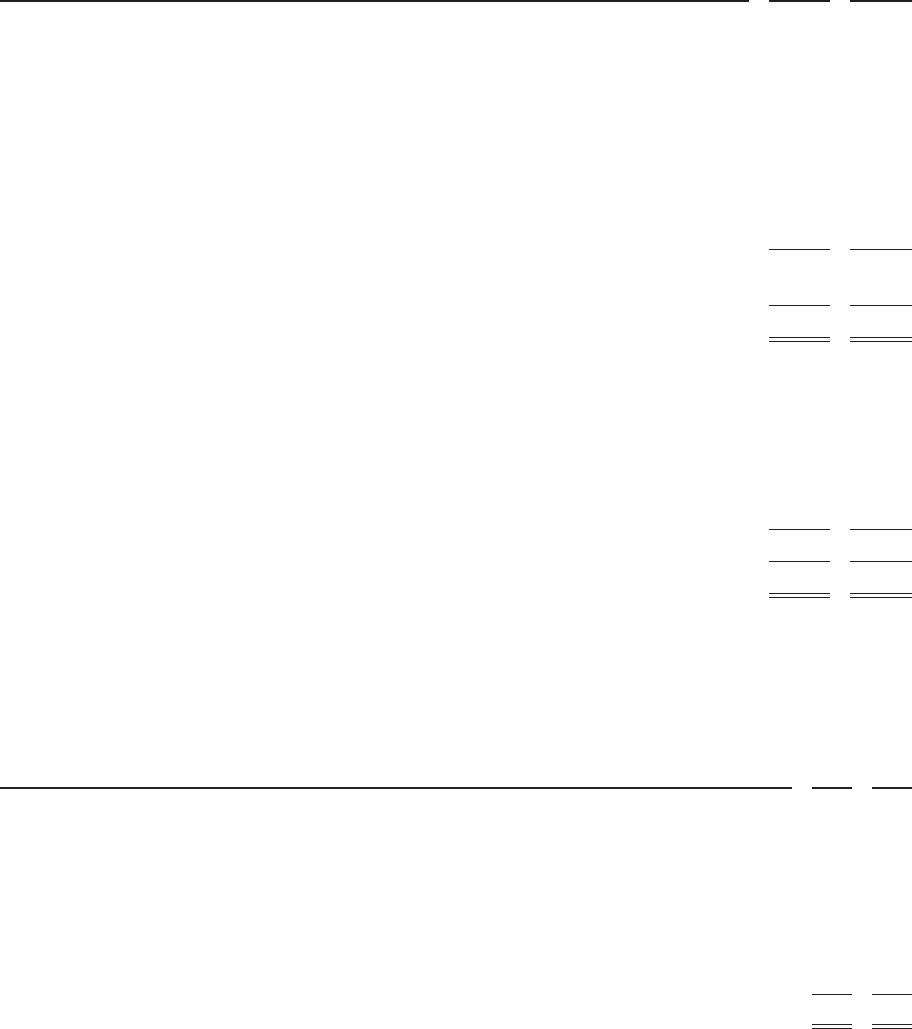

The components of deferred income tax assets and liabilities as of December 31 are as follows:

(in millions) 2009 2008

Deferred income tax assets:

Share-based compensation ................................................. $ 419 $ 413

Medical costs payable and other policy liabilities ............................... 218 223

Net operating loss carryforwards ............................................ 206 213

Accrued expenses and allowances ........................................... 201 93

Long term liabilities ...................................................... 164 354

Unearned revenues ....................................................... 58 56

Unrecognized tax benefits ................................................. 55 100

Net unrealized losses on investments ......................................... — 15

Other .................................................................. 190 181

Subtotal .................................................................... 1,511 1,648

Less: valuation allowances ................................................. (198) (193)

Total deferred income tax assets ................................................ $1,313 $ 1,455

Deferred income tax liabilities:

Intangible assets ......................................................... $ (890) $ (885)

Capitalized software development ........................................... (449) (439)

Net unrealized gains on investments ......................................... (163) —

Prepaid expenses ......................................................... (90) —

Depreciation and amortization .............................................. (80) (5)

Interest rate swaps ....................................................... — (230)

Total deferred income tax liabilities .............................................. (1,672) (1,559)

Net deferred income tax liabilities ....................................... $ (359) $ (104)

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will not be

realized. The valuation allowances primarily relate to future tax benefits on certain state net operating loss

carryforwards. Federal net operating loss carryforwards of $36 million expire beginning in 2012 through 2026,

and state net operating loss carryforwards expire beginning in 2010 through 2028.

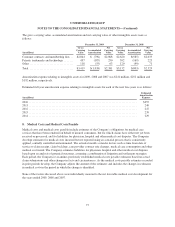

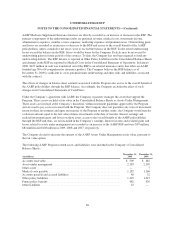

A reconciliation of the beginning and ending amount of unrecognized tax benefits as of December 31 is as

follows:

(in millions) 2009 2008

Gross unrecognized tax benefits, beginning of period .................................... $340 $271

Gross increases:

Current year tax positions ...................................................... 10 14

Prior year tax positions ........................................................ 11 43

Acquired reserves ............................................................ — 94

Gross decreases:

Prior year tax positions ........................................................ (62) (29)

Settlements ................................................................. (61) (4)

Statute of limitations lapses .................................................... (18) (49)

Gross unrecognized tax benefits, end of period ......................................... $220 $340

80