United Healthcare 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Equity Securities. Equity securities are held as available-for-sale investments. Fair value estimates for Level 1

and Level 2 publicly traded equity securities are based on quoted market prices and/or other market data for the

same or comparable instruments and transactions in establishing the prices. The fair values of Level 3

investments in venture capital portfolios are estimated using market modeling approaches that rely heavily on

management assumptions and qualitative observations. These investments totaled $282 million as of

December 31, 2009. The fair values of the Company’s various venture capital investments are computed using

limited quantitative and qualitative observations of activity for similar companies in the current market. The key

inputs utilized in the Company’s market modeling include, as applicable, transactions for comparable companies

in similar industries and having similar revenue and growth characteristics; similar preferences in the capital

structure; discounted cash flows; liquidation values and milestones established at initial funding; and the

assumption that the values of the Company’s venture capital investments can be inferred from these inputs. The

Company’s remaining Level 3 equity securities holdings of $30 million mainly consist of preferred stock for

which there is no active market.

Interest Rate Swaps. Fair values of the Company’s interest rate swaps were estimated using the terms of the

swaps and publicly available market yield curves. Because the swaps were unique and were not actively traded,

the fair values were classified as Level 2 estimates. As of December 31, 2009, the Company had no outstanding

interest rate swap contracts.

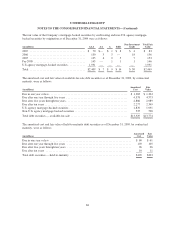

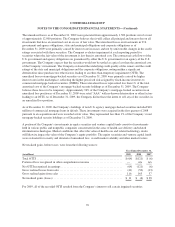

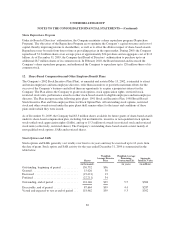

A reconciliation of the beginning and ending balances of assets measured at fair value on a recurring basis using

Level 3 inputs is as follows:

December 31, 2009 December 31, 2008

(in millions)

Debt

Securities

Equity

Securities Total

Debt

Securities

Equity

Securities Total

Balanceatbeginningofperiod..................... $ 62 $304 $366 $— $133 $133

Purchases, net ................................. 64 22 86 14 202 216

Net unrealized gains in accumulated other

comprehensive income ........................ — 7 7 — 2 2

Net realized losses in investment and other income . . . (6) (21) (27) — (54) (54)

Transfers into Level 3 .......................... — — — 48 21 69

Balance at end of period ......................... $120 $312 $432 $ 62 $304 $366

There were no significant fair value adjustments recorded during the year ended December 31, 2009 for

non-financial assets and liabilities or financial assets and liabilities that are measured at fair value on a

nonrecurring basis. These assets and liabilities are subject to fair value adjustments only in certain circumstances,

such as when the Company records impairments.

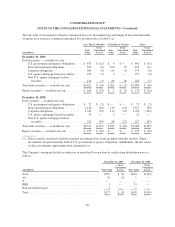

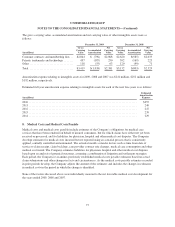

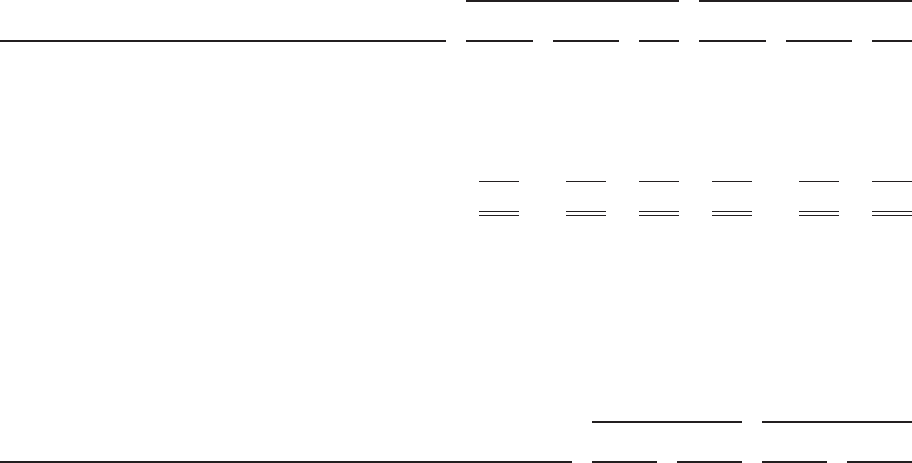

The table below includes fair values for certain financial instruments for which it is practicable to estimate fair

value. The carrying values and fair values of these financial instruments were as follows:

December 31, 2009 December 31, 2008

(in millions)

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

Assets

Debt securities — available-for-sale ............................ $13,774 $13,774 $13,472 $13,472

Equity securities — available-for-sale .......................... 577 577 477 477

Debt securities — held-to-maturity ............................. 199 203 200 210

AARP program-related investments ............................ 2,114 2,114 1,941 1,941

Interest rate swaps .......................................... — — 622 622

Liabilities

Senior unsecured notes ...................................... 11,173 11,043 12,693 10,941

73