United Healthcare 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sierra Health Services, Inc. On February 25, 2008, we acquired all of the outstanding shares of Sierra Health

Services, Inc. (Sierra), a diversified health care services company based in Las Vegas, Nevada, for approximately

$2.6 billion in cash, representing a price of $43.50 per share of Sierra common stock. This acquisition

strengthened our position in the southwest region of the United States. The U.S. Department of Justice approved

the acquisition conditioned upon the divestiture of our individual Medicare Advantage HMO plans in Clark and

Nye Counties, Nevada, which represented approximately 30,000 members. The divestiture was completed on

April 30, 2008. We received proceeds of $185 million for this transaction, which were recorded as a reduction to

Operating Costs. Group Medicare Advantage plans offered through commercial contracts were excluded from

the divestiture. Also, we retained Sierra’s Medicare Advantage HMO plans in Nevada. The results of operations

and financial condition of Sierra have been included in our consolidated results and the results of the Health

Benefits, OptumHealth and Prescription Solutions reporting segments since the acquisition date.

Fiserv Health, Inc. On January 10, 2008, we acquired all of the outstanding shares of Fiserv Health, Inc. (Fiserv

Health), a subsidiary of Fiserv, Inc., for approximately $740 million in cash. Fiserv Health is a leading

administrator of medical benefits and also provides care facilitation services, specialty health solutions and

pharmacy benefit management (PBM) services. This transaction allows us to expand the capacity of our existing

benefits administration businesses and enables existing and new customers to leverage our full range of assets,

including ancillary services, our national network and technology tools. The results of operations and financial

condition of Fiserv Health have been included in our consolidated results and the results of the Health Benefits,

OptumHealth, Ingenix and Prescription Solutions reporting segments since the acquisition date.

For the years ended December 31, 2009, 2008 and 2007, aggregate consideration paid, net of cash assumed for

smaller acquisitions was $95 million, $94 million and $262 million, respectively. These acquisitions were not

material to our results of operations.

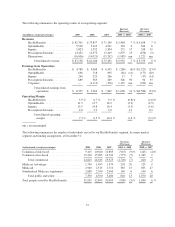

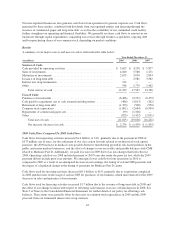

2009 RESULTS OF OPERATIONS COMPARED TO 2008 RESULTS

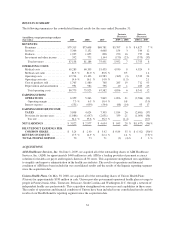

Consolidated Financial Results

Revenues

Consolidated revenues for 2009 increased primarily due to the increase in premium revenues in the Health

Benefits reporting segment. The increase in premium revenues was primarily due to strong organic growth in

risk-based offerings in our public and senior markets businesses and premium rate increases in response to

growth in underlying medical costs, partially offset by a decline in the number of people served in the

commercial market. The effect of 2008 Health Benefits acquisitions also contributed to the increase in premium

revenues during 2009.

Medical Costs

Medical costs for 2009 increased primarily due to growth in public and senior markets risk-based businesses, elevated

medical costs due to the H1N1 influenza virus, unemployment-related benefit continuation programs due to an

increased level of national unemployment, medical cost inflation and increased utilization of medical services.

For each period, our operating results include the effects of revisions in medical cost estimates related to all prior

periods. Changes in medical cost estimates related to prior periods, resulting from more complete claim

information identified in the current period, are included in total medical costs reported for the current period.

For 2009 and 2008, medical costs included $310 million and $230 million, respectively, of net favorable medical

cost development related to prior fiscal years.

Operating Costs

Operating costs for 2009 decreased due to certain expenses incurred in 2008 as discussed below and disciplined

operating cost management, which were partially offset by increased costs due to acquired and organic business

growth and from an increase in state insurance assessments levied against premiums, a portion of which was in

lieu of state income taxes in one of the states in which we operate.

35