United Healthcare 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(b) Represents 878,313 shares of our common stock repurchased during the period, and 2,484 shares of our

common stock withheld by us, as permitted by the applicable equity award certificates, to satisfy tax

withholding obligations upon vesting of shares of restricted stock.

(c) Represents 6,216,220 shares of our common stock repurchased during the period, and 58,009 shares of our

common stock withheld by us, as permitted by the applicable equity award certificates, to satisfy tax

withholding obligations upon vesting of shares of restricted stock.

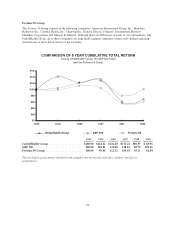

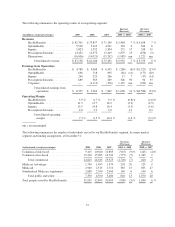

PERFORMANCE GRAPHS

The following two performance graphs compare the Company’s total return to shareholders with indexes of other

specified companies and the S&P 500 Index. The first graph compares the cumulative five-year total return to

shareholders on UnitedHealth Group’s common stock relative to the cumulative total returns of the S&P 500

index and a customized peer group (the “Fortune 50 Group”), an index of certain Fortune 50 companies for the

five-year period ended December 31, 2009. The second graph compares our cumulative total return to

shareholders with the S&P 500 Index and an index of a group of peer companies selected by us for the five-year

period ended December 31, 2009. The Company is not included in either the Fortune 50 Group index in the first

graph or the peer group index in the second graph. In calculating the cumulative total shareholder return of the

indexes, the shareholder returns of the Fortune 50 Group companies in the first graph and the peer group

companies in the second graph are weighted according to the stock market capitalizations of the companies at

January 1 of each year. The comparisons assume the investment of $100 on December 31, 2004 in Company

common stock and in each index, and that dividends were reinvested when paid.

27