United Healthcare 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITEDHEALTH GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

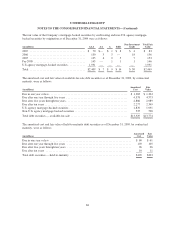

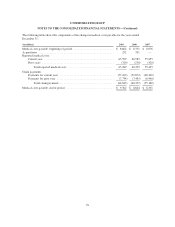

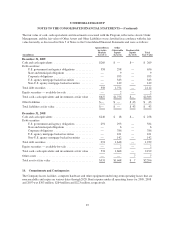

9. Commercial Paper and Long-Term Debt

Commercial paper and long-term debt consisted of the following:

December 31, 2009 December 31, 2008

(in millions)

Carrying

Value (a)

Fair

Value (b)

Carrying

Value (c)

Fair

Value (b)

Commercial Paper ...............................................$ — $ — $ 101$ 101

$250 million par, 3.8% senior unsecured notes due February 2009 ......... — — 250 250

$650 million par, senior unsecured floating-rate notes due March 2009 ...... — — 650 644

$450 million par, 4.1% senior unsecured notes due August 2009 ........... — — 455 442

$500 million par, senior unsecured floating-rate notes due June 2010 ....... 500 499 500 450

$250 million par, 5.1% senior unsecured notes due November 2010 ........ 257 259 263 245

$250 million par, senior unsecured floating-rate notes due February 2011 .... 250 251 250 219

$750 million par, 5.3% senior unsecured notes due March 2011 (e) ......... 781 777 806 705

$450 million par, 5.5% senior unsecured notes due November 2012 (e) ..... 480 481 493 410

$550 million par, 4.9% senior unsecured notes due February 2013 (e) ....... 549 575 549 513

$450 million par, 4.9% senior unsecured notes due April 2013 (e) .......... 464 472 473 419

$250 million par, 4.8% senior unsecured notes due February 2014 (e) ....... 268 256 280 221

$500 million par, 5.0% senior unsecured notes due August 2014 (e) ........ 540 518 567 460

$500 million par, 4.9% senior unsecured notes due March 2015 (e) ......... 544 513 567 429

$750 million par, 5.4% senior unsecured notes due March 2016 (e) ......... 847 772 883 661

$95 million par, 5.4% senior unsecured notes due November 2016 ......... 95 98 95 84

$500 million par, 6.0% senior unsecured notes due June 2017 (e) .......... 587 523 620 450

$250 million par, 6.0% senior unsecured notes due November 2017 (e) ..... 285 258 297 223

$1,100 million par, 6.0% senior unsecured notes due February 2018 ............

1,099 1,136 1,098 1,015

$1,095 million par, zero coupon senior unsecured notes due November 2022 (d) . . .

558 611 530 522

$850 million par, 5.8% senior unsecured notes due March 2036 ........... 844 762 844 648

$500 million par, 6.5% senior unsecured notes due June 2037 ............. 495 493 495 420

$650 million par, 6.6% senior unsecured notes due November 2037 ........ 645 651 645 548

$1,100 million par, 6.9% senior unsecured notes due February 2038 ........ 1,085 1,138 1,083 963

Total commercial paper and long-term debt ........................... 11,173 11,043 12,794 11,042

Less commercial paper and current maturities of long-term debt ........... (2,164) (2,173) (1,456) (1,437)

Long-term debt, less current maturities ...............................$ 9,009 $ 8,870 $11,338 $ 9,605

(a) The carrying value of the debt has been adjusted by the unamortized gain on related interest rate swaps,

which terminated in January 2009.

(b) Estimated based on third-party quoted market prices for the same or similar issues.

(c) The carrying value of debt had been adjusted based upon the applicable interest rate swap fair values in

accordance with the fair value hedge short-cut method of accounting.

(d) These notes have been classified with the current maturities of long-term debt in the Consolidated Balance

Sheet as of December 31, 2009 due to the existence of a put feature. For further discussion, see “Long-Term

Debt” below.

(e) A portion of these notes has been classified with the current maturities of long-term debt in the Consolidated

Balance Sheet as of December 31, 2009 due to the debt tender offers discussed under “Long-Term Debt” below.

77