United Healthcare 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CMS deploys a risk adjustment model, which apportions premiums paid to all health plans according to health

severity and certain demographic factors. The CMS risk adjustment model pays more for members whose

medical history indicates they have certain medical conditions. Under this risk adjustment methodology, CMS

calculates the risk adjusted premium payment using diagnosis data from hospital inpatient, hospital outpatient

and physician treatment settings. We and other health care providers collect, capture, and submit the necessary

and available diagnosis data to CMS within prescribed deadlines. We estimate risk adjustment revenues based

upon the diagnosis data submitted and expected to be submitted to CMS.

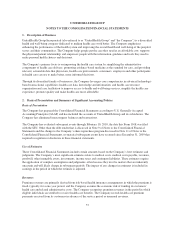

Goodwill and Intangible Assets

Goodwill. Goodwill represents the amount of the purchase price in excess of the fair values assigned to the

underlying identifiable net assets of acquired businesses. Goodwill is not amortized, but is subject to an annual

impairment test. Tests are performed more frequently if events occur or circumstances change that would more

likely than not reduce the fair value of the reporting unit below its carrying amount. To determine whether

goodwill is impaired, we perform a two-step impairment test. In the first step of the test, the fair values of the

reporting units are compared to their aggregate carrying values, including goodwill. If the fair value of the

reporting unit is greater than its carrying amount, goodwill is not impaired and no further testing is required. If

the fair value of the reporting unit is less than its carrying amount, we would proceed to step two of the test. In

step two of the test, the implied fair value of the goodwill of the reporting unit is determined by a hypothetical

allocation of the fair value calculated in step one to all of the assets and liabilities of that reporting unit (including

any recognized and unrecognized intangible assets) as if the reporting unit had been acquired in a business

combination and the fair value was reflective of the price paid to acquire the reporting unit. The implied fair

value of goodwill is the excess, if any, of the calculated fair value after hypothetical allocation to the reporting

unit’s assets and liabilities. If the implied fair value of the goodwill is greater than the carrying amount of the

goodwill at the analysis date, goodwill is not impaired and the analysis is complete. If the implied fair value of

the goodwill is less than the carrying value of goodwill at the analysis date, goodwill is deemed impaired by the

amount of that variance.

We calculate the estimated fair value of our reporting units using discounted cash flows. To determine fair values

we must make assumptions about a wide variety of internal and external factors. Significant assumptions used in

the impairment analysis include financial projections of free cash flow (including significant assumptions about

operations, capital requirements and income taxes), long-term growth rates for determining terminal value, and

discount rates. Where available and appropriate, comparative market multiples are used to corroborate the results

of our discounted cash flow test.

We completed our annual assessment of goodwill as of January 1, 2010 and determined that no impairment

existed as of December 31, 2009. Although we believe that the financial projections used are reasonable and

appropriate for all of our reporting units, there is uncertainty inherent in those projections. That uncertainty is

increased by potential health care reforms as discussed in “Proposed Health Care Reforms and Reimbursement

Changes” above, as any passed legislation may significantly change the forecasts and long-term growth rate

assumptions for some or all of our reporting units.

Intangible assets. Finite lived intangible assets are acquired in a business combination and are assets that

represent future expected benefits but lack physical substance (e.g., customer lists and trademarks). We do not

have material holdings of indefinite lived intangible assets. Intangible assets are amortized over their expected

useful lives and are subject to impairment tests when events or circumstances indicate that a finite lived

intangible asset’s (or asset group’s) carrying value may exceed its estimated fair value. If the carrying value

exceeds its estimated fair value, an impairment would be recorded.

We calculate the estimated fair value of finite lived intangible assets using undiscounted cash flows that are

expected to result from the use of the intangible asset or group of assets. We consider many factors, including

estimated future utility to estimate cash flows. There were no material impairments of finite lived intangible

assets during the current year.

48