United Healthcare 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

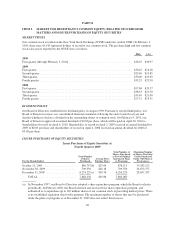

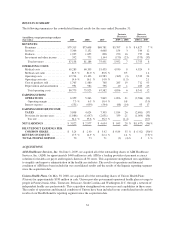

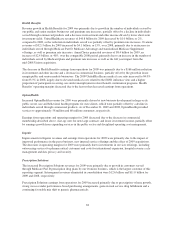

ITEM 6. SELECTED FINANCIAL DATA

FINANCIAL HIGHLIGHTS

For the Year Ended December 31,

(in millions, except percentages and per share data) 2009 (a,b) 2008 (a,b) 2007 (a,b) 2006 (a,b) 2005 (b)

Consolidated Operating Results

Revenues ....................................... $87,138 $81,186 $75,431 $71,542 $46,425

Earnings from operations ........................... 6,359 5,263 7,849 6,984 5,080

Net earnings ..................................... 3,822 2,977 4,654 4,159 3,083

Return on shareholders’ equity ...................... 17.3% 14.9% 22.4% 22.2% 25.2%

Basic net earnings per common share ................. $ 3.27 $ 2.45 $ 3.55 $ 3.09 $ 2.44

Diluted net earnings per common share ................ 3.24 2.40 3.42 2.97 2.31

Common stock dividends per share ................... 0.030 0.030 0.030 0.030 0.015

Consolidated Cash Flows From (Used For)

Operating activities ............................... $ 5,625 $ 4,238 $ 5,877 $ 6,526 $ 4,083

Investing activities ................................ (976) (5,072) (4,147) (2,101) (3,489)

Financing activities ............................... (2,275) (605) (3,185) 474 836

Consolidated Financial Condition

(As of December 31)

Cash and investments .............................. $24,350 $21,575 $22,286 $20,582 $14,982

Total assets ...................................... 59,045 55,815 50,899 48,320 41,288

Total commercial paper and long-term debt ............ 11,173 12,794 11,009 7,456 7,095

Shareholders’ equity ............................... 23,606 20,780 20,063 20,810 17,815

Debt-to-total-capital ratio ........................... 32.1% 38.1% 35.4% 26.4% 28.5%

Financial Highlights should be read with the accompanying Management’s Discussion and Analysis of Financial

Condition and Results of Operations and Consolidated Financial Statements and Notes to the Consolidated

Financial Statements.

(a) On January 1, 2006, we began serving as a plan sponsor offering Medicare Part D drug insurance coverage

under a contract with CMS. Total revenues generated under this program were $6.4 billion, $5.8 billion,

$5.9 billion and $5.7 billion for the years ended December 31, 2009, 2008, 2007 and 2006, respectively. See

Note 2 of Notes to the Consolidated Financial Statements for a detailed discussion of this program.

(b) We acquired Unison Health Plans in May 2008 for total consideration of approximately $930 million, Sierra

Health Services, Inc. in February 2008 for total consideration of approximately $2.6 billion, Fiserv Health,

Inc. in January 2008 for total consideration of approximately $740 million and PacifiCare Health Systems,

Inc. in December 2005 for total consideration of approximately $8.8 billion. The results of operations and

financial condition of these acquisitions have been included in our Consolidated Financial Statements since

the respective acquisition dates.

30