United Healthcare 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

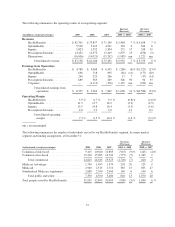

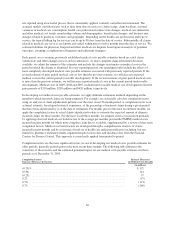

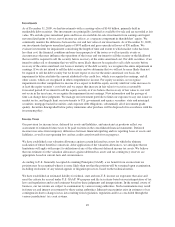

Medical cost PMPM trend factors are the most significant factors we use in developing our medical costs payable

estimates for the most recent three months. The following table illustrates the sensitivity of these factors and the

estimated potential impact on our medical costs payable estimates for the most recent three months as of

December 31, 2009:

Medical Cost PMPM Trend

Increase (Decrease) in Factors

Increase (Decrease) in

Medical Costs Payable

(in millions)

3%....................................................................... $332

2 ........................................................................ 222

1 ........................................................................ 111

(1) ....................................................................... (111)

(2) ....................................................................... (222)

(3) ....................................................................... (332)

The analyses above include outcomes that are considered reasonably likely based on our historical experience

estimating liabilities for incurred but not reported benefit claims.

Our estimate of medical costs payable represents management’s best estimate of our liability for unpaid medical

costs as of December 31, 2009, developed using consistently applied actuarial methods. Management believes

the amount of medical costs payable is reasonable and adequate to cover our liability for unpaid claims as of

December 31, 2009; however, actual claim payments may differ from established estimates. Assuming a

hypothetical 1% difference between our December 31, 2009 estimates of medical costs payable and actual

medical costs payable, excluding AARP Medicare Supplement Insurance, 2009 net earnings would increase or

decrease by $52 million and diluted net earnings per common share would increase or decrease by $0.04 per

share.

The current national health care cost inflation rate significantly exceeds the general inflation rate. We use various

strategies to lessen the effects of health care cost inflation. These include coordinating care with physicians and

other health care professionals and rate discounts from physicians and other health care professionals. Through

contracts with physicians and other health care professionals, we emphasize preventive health care, appropriate

use of health care services consistent with clinical performance standards, education and closing gaps in care.

We believe our strategies to mitigate the impact of health care cost inflation on our operating results have been

and will continue to be successful. However, other factors including competitive pressures, new health care

and pharmaceutical product introductions, demands from physicians and other health care professionals and

consumers, major epidemics, and applicable regulations may affect our ability to control the impact of health

care cost inflation. Because of the narrow operating margins of our risk-based products, changes in medical cost

trends that were not anticipated in establishing premium rates can create significant changes in our financial

results.

Revenues

Revenues are principally derived from health care insurance premiums. We recognize premium revenues in the

period eligible individuals are entitled to receive health care services. Customers are typically billed monthly at a

contracted rate per eligible person multiplied by the total number of people eligible to receive services, as

recorded in our records. Employer groups generally provide us with changes to their eligible population one

month in arrears. Each billing includes an adjustment for prior period changes in eligibility status that were not

reflected in our previous billing. We estimate and adjust the current period’s revenues and accounts receivable

accordingly. Our estimates are based on historical trends, premiums billed, the level of contract renewal activity

and other relevant information. We revise estimates of revenue adjustments each period and record changes in

the period they become known.

47