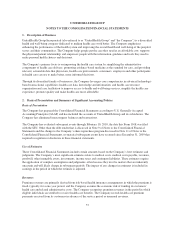

United Healthcare 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Investments

As of December 31, 2009, we had investments with a carrying value of $14.6 billion, primarily held in

marketable debt securities. Our investments are principally classified as available-for-sale and are recorded at fair

value. We exclude gross unrealized gains and losses on available-for-sale investments from earnings and report

net unrealized gains or losses, net of income tax effects, as a separate component in shareholders’ equity. We

continually monitor the difference between the cost and fair value of our investments. As of December 31, 2009,

our investments had gross unrealized gains of $493 million and gross unrealized losses of $50 million. We

evaluate investments for impairment considering the length of time and extent to which market value has been

less than cost, the financial condition and near-term prospects of the issuer as well as specific events or

circumstances that may influence the operations of the issuer and our intent to sell the security or the likelihood

that we will be required to sell the security before recovery of the entire amortized cost. For debt securities, if we

intend to either sell or determine that we will be more likely than not be required to sell a debt security before

recovery of the entire amortized cost basis or maturity of the debt security, we recognize the entire impairment in

earnings. If we do not intend to sell the debt security and we determine that we will not be more likely than not

be required to sell the debt security but we do not expect to recover the entire amortized cost basis, the

impairment is bifurcated into the amount attributed to the credit loss, which is recognized in earnings, and all

other causes, which are recognized in other comprehensive income. For equity securities, we recognize

impairments in other comprehensive income if we expect to hold the equity security until fair value increases to

at least the equity security’s cost basis and we expect that increase in fair value to occur in a reasonably

forecasted period. If we intend to sell the equity security or if we believe that recovery of fair value to cost will

not occur in the near term, we recognize the impairment in net earnings. New information and the passage of

time can change these judgments. We manage our investment portfolio to limit our exposure to any one issuer or

market sector, and largely limit our investments to U.S. government and agency securities; state and municipal

securities; mortgage-backed securities; and corporate debt obligations, substantially all of investment grade

quality. Securities downgraded below policy minimums after purchase will be disposed of in accordance with the

investment policy.

Income Taxes

Our provision for income taxes, deferred tax assets and liabilities, and uncertain tax positions reflect our

assessment of estimated future taxes to be paid on items in the consolidated financial statements. Deferred

income taxes arise from temporary differences between financial reporting and tax reporting bases of assets and

liabilities, as well as net operating loss and tax credit carryforwards for tax purposes.

We have established a net valuation allowance against certain deferred tax assets for which the ultimate

realization of future benefits is uncertain. After application of the valuation allowances, we anticipate that no

limitations will apply with respect to utilization of any of the other net deferred income tax assets. We believe

that our estimates for the valuation allowances against deferred tax assets and tax contingency reserves are

appropriate based on current facts and circumstances.

According to U.S. Generally Accepted Accounting Principles (GAAP), a tax benefit from an uncertain tax

position may be recognized when it is more likely than not that the position will be sustained upon examination,

including resolutions of any related appeals or litigation processes, based on the technical merits.

We have established an estimated liability for federal, state and non-U.S. income tax exposures that arise and

meet the criteria for accrual under U.S. GAAP. We prepare and file tax returns based on our interpretation of tax

laws and regulations and record estimates based on these judgments and interpretations. In the normal course of

business, our tax returns are subject to examination by various taxing authorities. Such examinations may result

in future tax and interest assessments by these taxing authorities. Inherent uncertainties exist in estimates of tax

contingencies due to changes in tax law resulting from legislation, regulation and/or as concluded through the

various jurisdictions’ tax court systems.

49