United Healthcare 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shelf Registration. In February 2008, we filed a universal S-3 shelf registration statement with the SEC

registering an unspecified amount of debt securities.

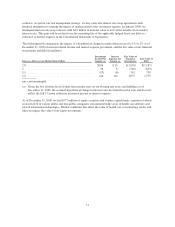

Credit Ratings. Our credit ratings at December 31, 2009 were as follows:

Moody’s Standard & Poor’s Fitch

Ratings Outlook Ratings Outlook Ratings Outlook

Senior unsecured debt ......................... Baa1 Stable A- Negative A- Negative

Commercial paper ............................ P-2 n/a A-2 n/a F1 n/a

The availability of financing in the form of debt or equity is influenced by many factors, including our

profitability, operating cash flows, debt levels, credit ratings, debt covenants and other contractual restrictions,

regulatory requirements and economic and market conditions. For example, a significant downgrade in our credit

ratings or conditions in the capital markets may increase the cost of borrowing for us or limit our access to

capital. We have therefore adopted strategies and actions toward maintaining financial flexibility to mitigate the

impact of such factors on our ability to raise capital.

Debt Tender. In February 2010, we completed cash tender offers for $775 million aggregate principal amount of

certain of our outstanding notes. We believe this debt repurchase will improve the matching of floating rate

assets and liabilities on our balance sheet and reduce our debt service cost. We used cash on hand to fund the

purchase of the notes.

Share Repurchases. Under our Board of Directors’ authorization, we maintain a common share repurchase

program. Repurchases may be made from time to time at prevailing prices in the open market. In 2009, we

repurchased 74.3 million shares at an average price of approximately $24 per share and an aggregate cost of $1.8

billion. As of December 31, 2009, we had Board of Directors’ authorization to purchase up to an additional

28.7 million shares of our common stock. In February 2010, the Board renewed and increased our share

repurchase program, and authorized us to repurchase up to 120 million shares of our common stock.

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

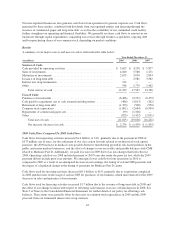

The following table summarizes future obligations due by period as of December 31, 2009, under our various

contractual obligations and commitments:

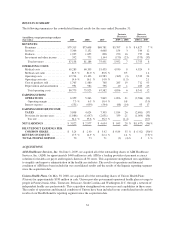

(in millions) 2010 2011 to 2012 2013 to 2014 Thereafter Total

Debt (a) ...................................... $2,164 $1,361 $1,559 $ 6,089 $11,173

Interest on debt (b) ............................. 545 659 406 3,549 5,159

Operating leases ............................... 255 420 272 644 1,591

Purchase obligations (c) ......................... 115 31 — — 146

Future policy benefits (d) ........................ 139 353 337 1,152 1,981

Unrecognized tax benefits (e) ..................... 19 — — 104 123

Unfunded investment commitments (f) ............. 138 42 24 16 220

Other obligations (g) ........................... 210 80 — 252 542

Total contractual obligations ................. $3,585 $2,946 $2,598 $11,806 $20,935

(a) See Note 9 of Notes to the Consolidated Financial Statements for more detail.

(b) Calculated using stated rates from the debt agreements and assuming amounts are outstanding through their

contractual term, including the effect of the debt tender described in Note 9 of Notes to the Consolidated

Financial Statements. For variable-rate obligations, we used the rates in place as of December 31, 2009 to

estimate all remaining contractual payments. Includes unamortized discounts from par values.

(c) Includes fixed or minimum commitments under existing purchase obligations for goods and services,

including agreements that are cancelable with the payment of an early termination penalty. Excludes

agreements that are cancelable without penalty and excludes liabilities to the extent recorded in our

Consolidated Balance Sheets as of December 31, 2009.

44